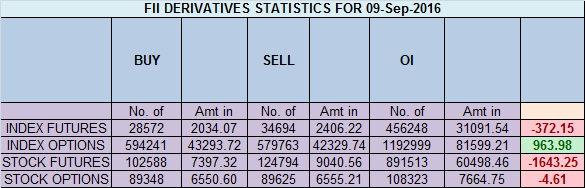

- FII’s sold 6.1 K contract of Index Future worth 372 cores ,6.4 K Long contract were liquidated by FII’s and 0.3 K short contracts were liquidated by FII’s. Net Open Interest increased by 6.8 K contract, so fall in market was used by FII’s to exit long and exit shorts in Index futures. What separates amateur traders from the pros?

- As discussed last Analysis Now 8951 will become the new 8577. Closing above it Nifty can move all the way towards 9045/9189/9334,Closing below it 8856/8716/8622 are the targets for the September series. 8910 will play very crucial role in next 2 trading session as break of that can see quick fall towards 8820 level and holding the same bulls will make one more attempt for a close above 8951 and move towards the sacrosanct level of 9000. Low made today was 8896 and nifty recovered to close just above 8951 level. Now Bulls will be able to materialize and close nifty above 9000 level as we approach weekly closing tomorrow. We were expecting market to touch 9000 but market had its mind of own and thats where i highlight the need to have a trading plan, Below 8951/8910 bears had upper hand as we have discussed before in our analysis, High made yesterday was 8939 nifty was not able to go above 8951 and broke 8910 also, suggesting bears have upperhand and we can see all the was till 8820/8760. 8756-8760 if and when it comes is very important level, if held nifty can again make one more attempt towards 9000. Bank Nifty pause in uptrend,EOD Analysis

- Nifty Sep Future Open Interest Volume is at 3.34 core with liquidation of 9.1 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8686, closed above it rallied 250 points.

- Total Future & Option trading volume was at 3.37 Lakh core with total contract traded at 0.93 lakh , PCR @1.4 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 66.3 lakh, resistance at 9000 .8500/9000 CE added 10 lakh so finally bears added aggressively in 9000 .FII bought 2.3 K CE longs and 10.9 K CE were shorted by them .Retail bought 60.4 K CE contracts and 24.1 K shorted CE were covered by them.

- 8600 PE OI@58.1 lakhs having the highest OI strong support at 8600. 8300-8800 PE liquidated 12.6 Lakh in OI so bulls making strong base near 8700-8750 zone .FII bought 22.8 K PE longs and 0.2 K shorted PE were covered by them .Retail sold 26.7 K PE contracts and 10 K shorted PE were covered by them.

- FII’s sold 315 cores in Equity and DII’s sold 328 cores in cash segment.INR closed at 66.67

- Nifty Futures Trend Deciding level is 8919 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8811 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8840 Tgt 8860,8888 and 8910 (Nifty Spot Levels)

Sell below 8800 Tgt 8780,8760 and 8720 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

should i book my shorts at a 1.25% or keep trailing sl . pl advise

Sir

pls recheck. we closed at 8866.7 on friday

tx

levels are correct sir..

Market is likely to gap down on Monday opening, followed by some recovery

Sir, Do you expect Massive Fall on Nifty on Monday and Nifty upto 8550.

Sir 8840 par buy how come ,we are at 8666 spot .Is it correct.