- FII’s sold 2.5 K contract of Index Future worth 173 cores ,5.2 K Long contract were liquidated by FII’s and 2.7 K short contracts were liquidated by FII’s. Net Open Interest increased by 7.9 K contract, so rise in market was used by FII’s to exit long and exit shorts in Index futures. WD Gann Trading Rules Part-II

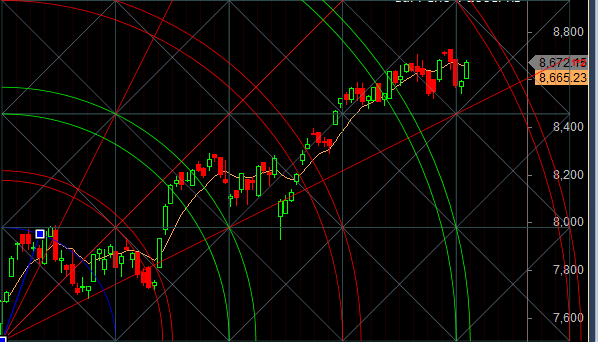

- As discussed in Yesterday Analysis Bears failed to do follow up move below 8577 and bulls were able to close above 8577 suggesting nifty can see another upmove towards 8656/8752. We are near trend change as per horizontal line and as per time analysis expect an impulsive move tomorrow. Nifty made low of 8604 and rallied towards 8656, More than 100 points above 8577 gann level and also trend change was seen as we discussed. Now Bulls need to close above the range of 8711 for next move towards 8779-8800-8851. Bears will get active on close below 8484 only. Bank Nifty rallies above 18700,EOD Analysis

- Nifty Aug Future Open Interest Volume is at 2.46 core with liquidation of 8.7 Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @8650, closed above it.

- Total Future & Option trading volume was at 3.21 Lakh core with total contract traded at 1.4 lakh , PCR @1.11, Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 56.6 lakh, resistance at 8800 .8500/9000 CE liquidated 20 lakh so resistance formation in 8800-8900 zone again seeing crack, Will Bulls be able to capitalize now ? .FII bought 14.2 K CE longs and 12 K shorted CE were covered by them .Retail sold 42 K CE contracts and 12 K CE were shorted by them.

- 8500 PE OI@56.1 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 13.5 Lakh in OI so bulls making strong base near 8550-8600 zone .FII sold 10.4 K PE longs and 2.3 K PE were shorted by them .Retail bought 69.2 K PE contracts and 18.9 K PE were shorted by them.

- FII’s bought 1203 cores in Equity and DII’s sold 393 cores in cash segment.INR closed at 66.89

- Nifty Futures Trend Deciding level is 8672 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8663 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8704 Tgt 8733,8752 and 8782 (Nifty Spot Levels)

Sell below 8650 Tgt 8623,8600 and 8575 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Sir,

NF Rollover cost @8650, closed above it. LTP was 8672 and CP 8678.4.

So please correct above.

Thanks corrected..

Sir, You are an Amazing Trader…

I bow my head for you.. each and every analysis you do on each and every day…

I doesnt know how many fans are there for you…

But…

I Am An Hardcore Fan Of You.. Sir…

I became Addict for you… Awaiting waiting for your words through Analysis…

Sorry If you found that I am talking more… But please consider my above lines are from my real feelings from my Real Heart…

Thank you..

Me too….

Appreciated for your kind words..

AM happy am able to help you in your trading…

Ge sirji “8800-8900 zone again seeing crack” in this does crack mean that level may be break of resistance

yes sir