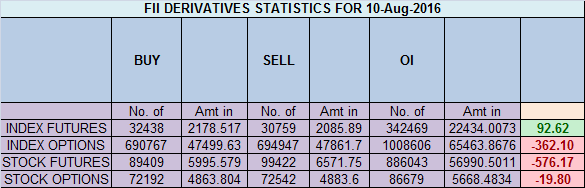

- FII’s bought 1.6 K contract of Index Future worth 92 cores ,2.2 K Long contract were added by FII’s and 0.5 K short contracts were added by FII’s. Net Open Interest increased by 2.8 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. Why You Can’t Cut Losses

- As discussed in Yesterday Analysis Bulls need to protect 8677 in any correction to continue upmove towards 8800/8851 zone as seen in below gann chart. Nifty as soon as broke 8677 and sustained below it bears pushed the prices down, and finally closing below 8577. Bears need to sustain below 8577 for target of 8517/8476. Bulls will get active again on close above 8577 for next move towards 8656/8752. Bank Nifty saw impulsive down move below 18915,EOD Analysis

- Nifty Aug Future Open Interest Volume is at 2.55 core with addition of 9.2 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8650, closed below it.

- Total Future & Option trading volume was at 3.68 Lakh core with total contract traded at 1.5 lakh , PCR @0.87, Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 62 lakh, resistance at 8800 .8500/9000 CE added 4.1 lakh so resistance formation in 8800-8900 zone .FII sold 6.4 K CE longs and 22.5 K CE were shorted by them .Retail bought 115 K CE contracts and 28.8 K CE were shorted by them.

- 8500 PE OI@53.3 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 3.6 Lakh in OI so bulls making strong base near 8550-8600 zone, need to see if it holds tomorrow .FII bought 26 K PE longs and 1.2 K PE were shorted by them .Retail sold 23 K PE contracts and 28.4 K PE were shorted by them.

- FII’s bought 412 cores in Equity and DII’s sold 747 cores in cash segment.INR closed at 66.84

- Nifty Futures Trend Deciding level is 8630 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8669 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8590 Tgt 8610,8625 and 8655 (Nifty Spot Levels)

Sell below 8550 Tgt 8530,8510 and 8490 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Sir..How many points should be the SL for the Nifty triggers after entry..please advise

21 points

Looks market is verge on the crash..support will come in at 8560 nifty futures..if that goes.. downside target is 8450…if nifty takes support at 8560 then ww can see 8800 for this expiry

Crash rise are part of market cycle, as a trader you should have a plan to follow the cycles..

Take each day as it comes my friend. Respect your screen and leave every other thought out. Stick to your trading plan. Keeping support and resistance values in mind is fine. But they should not rule your trade.