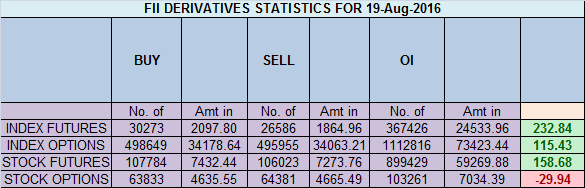

- FII’s bought 3.6 K contract of Index Future worth 232 cores ,5.7 K Long contract were added by FII’s and 2 K short contracts were added by FII’s. Net Open Interest increased by 7.8 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. Trading Psychology : Walking The Plank

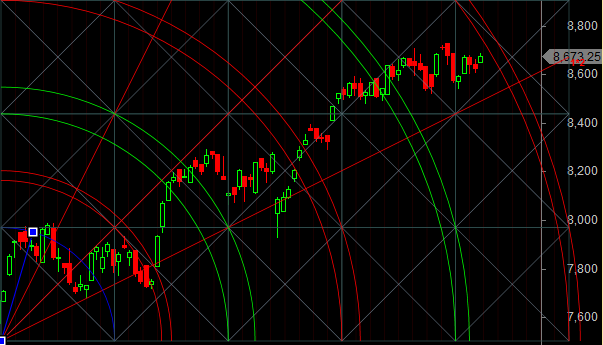

- As discussed in Yesterday Analysis Now Bulls need to close above the range of 8711 for next move towards 8779-8800-8851. Bears will get active on close below 8484 only. Its been 20 days we have traded in range of 204 points 8517-8721, suggesting market is seeing time correction frustrating traders and hitting SL, traders who survive this phase by applying risk and money management are rewarded handsomely in the next move . High made today was 8696 so bulls need to wait for break of 8711-8723 range for further upmove. Bulls above 8723 can see move till 8851/8900, bears below 8484 can see move till 8400/8350. As per gann analysis 23-24 Aug are important trend change date so we might see end of time correction near that time. Bank Nifty almost does 19500 target, EOD Analysis

- Nifty Aug Future Open Interest Volume is at 2.32 core with liquidation of 6.3 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover cost @8650, closed above it, trading near rollover range suggesting big move round the corner.

- Total Future & Option trading volume was at 3 Lakh core with total contract traded at 0.93 lakh , PCR @1.09, Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 73.9 lakh, resistance at 8800 .8500/9000 CE added 10 lakh so resistance formation in 8800-8900 zone .FII sold 260 CE longs and 8.7 K CE were shorted by them .Retail bought 26.3 K CE contracts and 21.7 K CE were shorted by them.

- 8500 PE OI@59.5 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 3 Lakh in OI so bulls making strong base near 8550-8600 zone .FII bought 11.8 K PE longs and 0.5 K PE were shorted by them .Retail bought 34.1 K PE contracts and 0.5 K PE were shorted by them.

- FII’s bought 409 cores in Equity and DII’s bought 106 cores in cash segment.INR closed at 67.06

- Nifty Futures Trend Deciding level is 8677 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8663 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8675 Tgt 8695,8719 and 8740 (Nifty Spot Levels)

Sell below 8640 Tgt 8620,8595 and 8577 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Nifty close to complete its time correction???? Did it means ready for another upmove?

Thank You Sir….