Ambuja Cement

Positional Traders can use the below mentioned levels

Close below 254 Tgt 241/238

Intraday Traders can use the below mentioned levels

Buy above 260 Tgt 262.3,265 and 268 SL 258

Sell below 256 Tgt 254,251 and 247 SL 257.5

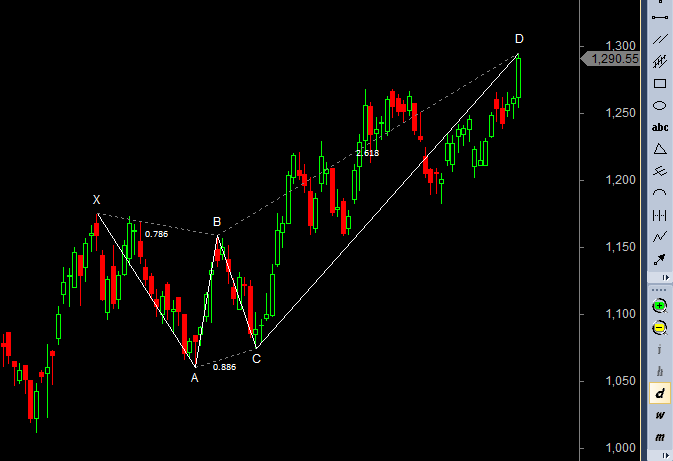

HDFC

Positional Traders can use the below mentioned levels

Unable to close above 1321 Tgt 1245/1220

Intraday Traders can use the below mentioned levels

Buy above 1296 Tgt 1301,1311 and 1321 SL 1290

Sell below 1288 Tgt 1280.5,1272 and 1265 SL 1292

M&M

Positional Traders can use the below mentioned levels

Close below 1453 Tgt 1410/1364

Intraday Traders can use the below mentioned levels

Buy above 1459 Tgt 1467,1478 and 1487 SL 1453

Sell below 1446 Tgt 1440,1430 and 1420 SL 1451

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for June Month, Intraday Profit of 3.12 Lakh and Positional Profit of 3.08 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/14011718

Sir,has BEL been initiated (sell),google finance closing is above 1260 where as IIFL watchlist closing is 1258,pls clarify.

Hi Brameshji… Your research is amazing… I have seen them moving in one or the other direction… But very hard to find the direction when the market is flat. Would it be not possible for you to give one direction calls ? It would help small time traders to make some money… I lost money yesterday in all 3 SL hit.. then I was afraid to take a position again… I really appreciate your work, but it would be very nice if you can give one direction to calls based on the previous days close….Thanks..and hope not asking for too much 😉

As a trader i can never be biased towards one direction.. I have to prepare myself for eventuality..

you are using the words 1.close below 2.unable to close above.Does it give two different meaning.I request you to clarify please