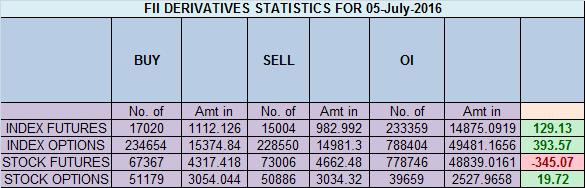

- FII’s bought 2 K contract of Index Future worth 129 cores ,2.6K Long contract were added by FII’s and 0.06 K short contracts were added by FII’s. Net Open Interest increased by 3.2 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. How Long Does It Take To Learn How To Trade?

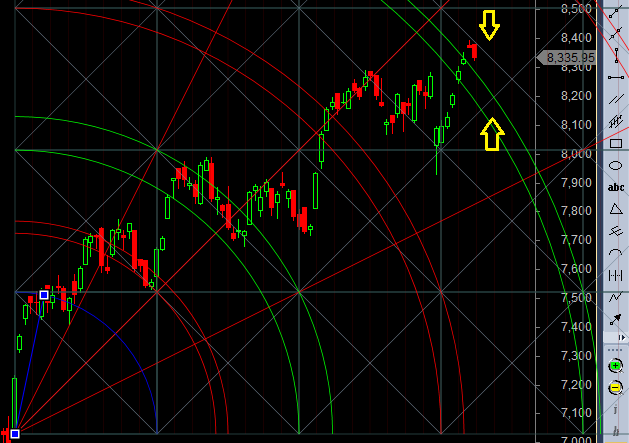

- As discussed in Yesterday Analysis Bulls need a close above 8336 and 8372 which is a very important gann number, Unable to close above 8372 we can see a fall towards 8210. High made today was 8381 but again closed below 8372 and 8336 suggesting the importance of 8372 and 8336. The range of 8336-8372 is very important both from gann perceptive and supply and demand concept. This range nifty spent of lot time both while going up and coming down so lot of churning needs to happen before next move. Breakout only on close of 8372 for target of 8488/8548/8700. Bears will get active only on close below 8100. Bank Nifty fails to give follow move above 18051,EOD Analysis

- Nifty July Future Open Interest Volume is at 1.89 core with liquidation of 1.5 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover is at 73% and Rollover cost @8204 closed above it

- Total Future & Option trading volume was at 1.93 Lakh core with total contract traded at 1.11 lakh , PCR @1.08, Trader’s Resolutions for the New Financial Year 2016-17

- 8400 CE is having Highest OI at 43.6 lakh, resistance at 8400 .8400/8700 CE added 12.7 lakh so bears forming resistance at higher levels 8400-8700 zone .FII bought 8 K CE longs and 5.1 K CE were shorted by them .Retail bought 39.4 K CE contracts and 21.1 K CE were shorted by them.

- 8200 PE OI@42.1 lakhs having the highest OI strong support at 8200. 8000-8300 PE added 3.8 Lakh in OI so bulls making strong base near 8100-8200 zone .FII bought 12.6 K PE longs and 9.4 K PE were shorted by them .Retail bought 12.4 K PE contracts and 21.1 K PE were shorted by them.

- FII’s bought 265 cores in Equity and DII’s sold 447 cores in cash segment.INR closed at 67.45

- Nifty Futures Trend Deciding level is 8359 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8354How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8350 Tgt 8371,8400 and 8433 (Nifty Spot Levels)

Sell below 8300 Tgt 8285,8250 and 8210 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Nifty had a volatile June Series High made in the series was 8467 and low was 7940 and closed at 8398. So we had a move of 527 points but comparing from May Expiry which happened at 8317 we just moved 81 points. So expect July Series to see some range expansion

This is what we discussed in yesterday analysis Nifty even after the pullback formation of Higher High and Higher low stays as 8334 low was not broken yesterday. So if 8326 range not broken today we can close at the high point of the expiry. Low made was 8329 and we made high 8423 near expiry range. Till we do not see pullback of more than 83 points uptrend continues. Crossing gann 3×1 angle can see rally extending further 8470/8600 odd levels. Strong support at 8250 odd levels. Market might consolidate in range of 8470-8250 before making the next move.

Sir don’t mistake me .This is the outlook written by you for July 2015 series.Same level we are now.Will July be a volatile month? (Nifty went to 8655 in july 2015)

yes sir thats the right understanding..

Happy Ramzan Bramesh….May this Eid brings us all the happiness in our life…

Regards,

Sahanash