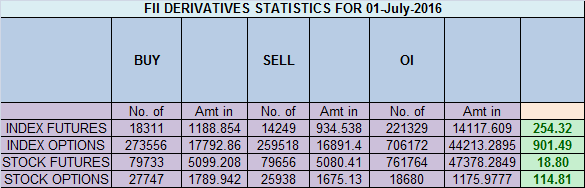

- FII’s bought 4 K contract of Index Future worth 254 cores ,5.2 K Long contract were added by FII’s and 1.1 K short contracts were added by FII’s. Net Open Interest increased by 6.3 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures.Detrended Price Oscillator (DPO) Introduction

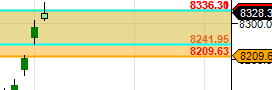

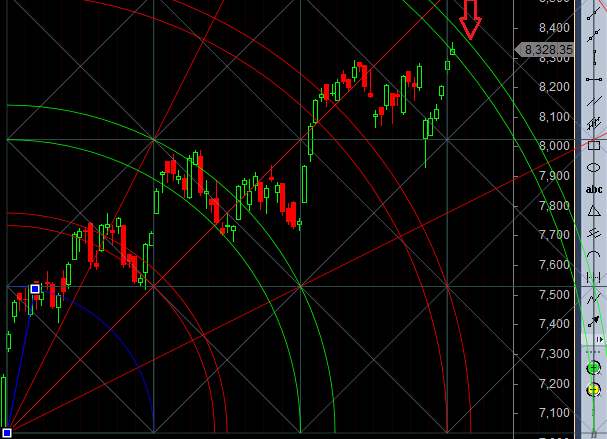

- As discussed in Yesterday Analysis Breakout only on close of 8336 for target of 8545/8700. Bears will get active only on close below 8100.High made today was 8356 but again closed below 8336 suggesting the importance of 8336. Bulls need a close above 8336 and 8372 which is a very important gann number, Unable to close above 8372 we can see a fall towards 8210. Breakout only on close of 8336 for target of 8545/8700. Bears will get active only on close below 8100. Bank Nifty fails to close above 18051,EOD Analysis

- Nifty July Future Open Interest Volume is at 1.87 core with addition of 3.2 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover is at 73% and Rollover cost @8204 closed above it

- Total Future & Option trading volume was at 1.76 Lakh core with total contract traded at 1.2lakh , PCR @1.03, Trader’s Resolutions for the New Financial Year 2016-17

- 8500 CE is having Highest OI at 43.1 lakh, resistance at 8500 .8500/8700 CE added 17.2 lakh so bears forming resistance at higher levels 8500-8700 zone .FII bought 8.1 K CE longs and 4.4 K CE were shorted by them .Retail bought 45.6 K CE contracts and 46.9 K CE were shorted by them.

- 8000 PE OI@42.3 lakhs having the highest OI strong support at 8000. 8000-8300 PE added 26.2 Lakh in OI so bulls making strong base near 8100-820 zone .FII bought 17.3 K PE longs and 7 K PE were shorted by them .Retail bought 65.3 K PE contracts and 52.5 K PE were shorted by them. Retailers playing for rangebound move as both call and put are shorted by them.

- FII’s sold 187 cores in Equity and DII’s bought 907 cores in cash segment.INR closed at 67.32

- Nifty Futures Trend Deciding level is 8360 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8332 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8360 Tgt 8380,8401 and 8426 (Nifty Spot Levels)

Sell below 8330 Tgt 8310,8285 and 8260 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh