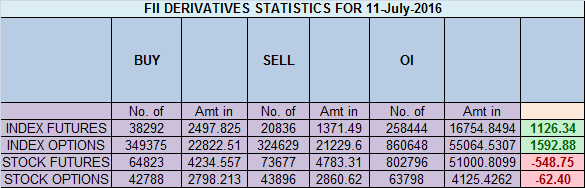

- FII’s bought 17.4 K contract of Index Future worth 1126 cores ,19 K Long contract were added by FII’s and 1.6 K short contracts were added by FII’s. Net Open Interest increased by 20.7 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. How Long Does It Take To Learn How To Trade?

- As discussed in Yesterday Analysis Breakout only on close of 8372 for target of 8488/8548/8700. Bears will get active only on close below 8100. Nifty on Friday closed below 8336/8372 suggesting bearish bias but today we had gap up above both levels suggesting the change in trend and this is what a trader should expertise changing colors as soon as market changes color. Bulls almost did the target of 8488, closing above it we are heading towards 8577 where bulls should take breather. Bearish on close below 8210. . Bank Nifty heading towards 18750,EOD Analysis

- Nifty July Future Open Interest Volume is at 1.99 core with addition of 16.7 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover is at 73% and Rollover cost @8204 closed above it

- Total Future & Option trading volume was at 2.59 Lakh core with total contract traded at 1.4 lakh , PCR @1.11, Trader’s Resolutions for the New Financial Year 2016-17

- 8500 CE is having Highest OI at 43.7 lakh, resistance at 8500 .8400/8700 CE added 11.5 lakh so bears forming resistance at higher levels 8450-8500 zone .FII bought 16.7 K CE longs and 2.8 K shorted CE were covered by them .Retail sold 3.8 K CE contracts and 29.4 K shorted CE were covered by them.

- 8200 PE OI@43.2 lakhs having the highest OI strong support at 8200. 8000-8400 PE added 28 Lakh in OI so bulls making strong base near 8300-8400 zone .FII bought 11.9 K PE longs and 6.8K PE were shorted by them .Retail bought 67.8 K PE contracts and 29.1 K PE were shorted by them.

- FII’s bought 1055 cores in Equity and DII’s sold 610 cores in cash segment.INR closed at 67.13

- Nifty Futures Trend Deciding level is 8471 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8367 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8500 Tgt 8520,8540 and 8561 (Nifty Spot Levels)

Sell below 8445 Tgt 8424,8410 and 8385 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

nifty sell target 8300

One thing is sure that trader can not catch every movement of market…..such gap up gap down always force trader to book huge loss if they are on wrong side. One has to be mentally tough to face such situations else it will create frustration nothing else……

This market is not a sell on rise but buy on dips market.

Hello sir I observe gaan lines.. But sir why candles keeps on shifting? if we look at previous candles.. It has shifted .. Plz give explanation

As the price keep moving up you need to adjust as it has only 5 arcs

Gap up opening never give money to traders also this time friday’s close suggesting negative bias while market open huge gap up and forced to cover shorts. Overall not a good day. Market rise by 500 points but money not made, infact booked loss.

If someone looses someone has to gain.. this is how market works..