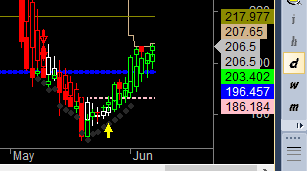

Adani Ports

Positional Traders can use the below mentioned levels

Close above 208 Tgt 212/220

Buy above 208 Tgt 210,212 and 215 SL 207

Sell below 206 Tgt 204.5,202 and 200 SL 207

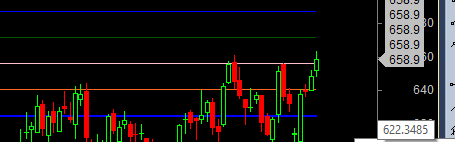

Century

Positional Traders can use the below mentioned levels

Close above 661 Tgt 689

Buy above 661 Tgt 665,670 and 678 SL 659

Sell below 656 Tgt 651,647 and 641 SL 659

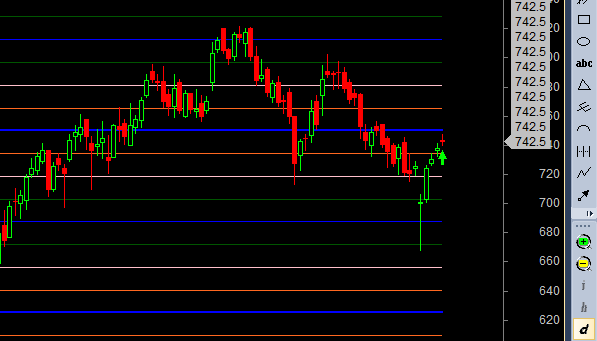

Auropharma

Positional Traders can use the below mentioned levels

Close above 754 Tgt 775/790

Buy above 748 Tgt 753,757 and 762 SL 744

Sell below 737 Tgt 730,724 and 715 SL 741

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for April Month, Intraday Profit of 2.31 Lakh and Positional Profit of 3.48 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/14011718

Positional Traders can use the below mentioned levels

Holding 712 Tgt 740/757

Buy above 724 Tgt 732,740 and 750 SL 723

Sell below 717 Tgt 712,707 and 700 SL 721

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for April Month, Intraday Profit of 2.31 Lakh and Positional Profit of 3.48 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/14011718

Sir,In your p&l sheet You have written entry price for CENTURYTEX as 662 on july1,but it closed below 661.Entry was initiated on july2 at 678.60(16000 difference)??!!

Please check your charts it closed on 664 on 1 July .. Do proper research before commenting ..

Sir why is there so much ambiguity when it comes to closing prices,google finance says it is 660.65 and IIFL charts say it is 664,same thing happened to BEL yesterday(google says 1263 and IIFL 1258).

Thanks Bramesh ji, made profits in adani ports and auro pharma today, the maturity that i attained is just because of you and your posts, thanks a lot.

i am holding KPIT Technologies @183

what is your suggestion on kpit

Sir, what does MML analysis stands for?

Murry Math Line