- FII’s bought 4.8 K contract of Index Future worth 320 cores ,6 K Long contract were added by FII’s and 1.2 K short contracts were added by FII’s. Net Open Interest increased by 7.2 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures.UK Brexit explained: What you need to know

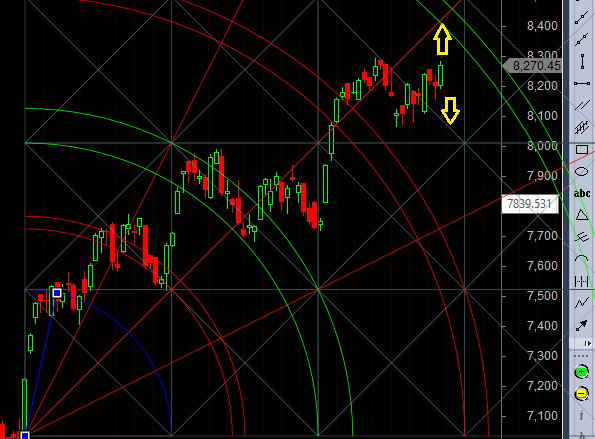

- As discussed in Yesterday Analysis Closing above 8210 is a very bullish sign and holding the same we can move towards 8300/8336/8410 in next few days.Bearish only on close below 8070. High made today was 8285 and low made was 8188,so 8210 showed effect. We did close at 8204 yesterday this is market way of confusing traders but gann trendline helped us not doing any shorting and today once it moved above 8210 just moved up impulsively. 22-June is an important gann data as per time analysis till 8153 not broken we can see upside till 8400/8450 near gann trendline as shown in below chart.Bulls will get momentum above 8336 and bears below 8150. Will Bank Nifty Break Gann arc after holding gann trendline ,EOD Analysis

- Nifty June Future Open Interest Volume is at 1.58 core with addition of 3.2 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @7961 closed above it

- Total Future & Option trading volume was at 3.57 Lakh core with total contract traded at 1.4 lakh , PCR @1.05, Trader’s Resolutions for the New Financial Year 2016-17

- 8400 CE is having Highest OI at 65.5 lakh, resistance at 8400 .8300/8600 CE added 6.1 lakh so bears forming resistance at higher levels 8300-8400 zone .FII sold 267 CE longs and 2.9 K shorted CE were covered by them .Retail sold 65.5 K CE contracts and 32.4 K shorted CE were covered by them.

- 8000 PE OI@80.5 lakhs having the highest OI strong support at 8000. 8000-8600 PE liquidated 11.8 Lakh in OI so bulls making strong base near 8100-8200 zone .FII bought 24.5 K PE longs and 14.6 K PE were shorted by them .Retail bought 11.6 K PE contracts and 9.3 K PE were shorted by them.

- FII’s bought 81 cores in Equity and DII’s bought 203 cores in cash segment.INR closed at 67.25

- Nifty Futures Trend Deciding level is 8248 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8194 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8310 Tgt 8340,8375 and 8405 (Nifty Spot Levels)

Sell below 8240 Tgt 8210,8180 and 8150 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh