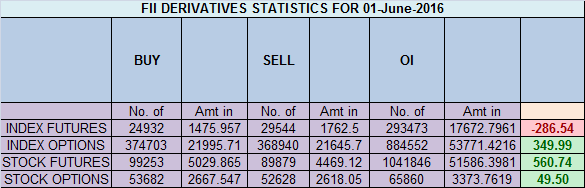

- FII’s sold 4.6 K contract of Index Future worth 286 cores ,149 Long contract were added by FII’s and 4.7 K short contracts were liquidated by FII’s. Net Open Interest increased by 4.9 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures.How to improve on trading results What is the main Reason for Your Trading Loss, We are running POLL on Twitter Please participate

- As discussed in Yesterday Analysis 8210-8241 is crucial as its a supply zone and also PRZ zone of ABCD pattern, Unable to close above it we can see down move till 8075/8100. High made today was exactly 8215, Bulls needs a close above 8210-8241 range for next move towards 8336/8400 else correction till 8075/8000. Bank Nifty reacts from gann arc,EOD Analysis

- Nifty June Future Open Interest Volume is at 2.14 core with liquidation of 1.3 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover cost @7961 closed above it

- Total Future & Option trading volume was at 1.81 Lakh core with total contract traded at 1.2 lakh , PCR @1, Trader’s Resolutions for the New Financial Year 2016-17

- 8200 CE is having Highest OI at 36 lakh, resistance at 8200 .8000/8500 CE bought 7.3 lakh so bears forming resistance at higher levels as nifty unable to close above 8210 .FII bought 7.7 K CE longs and 197 CE were shorted by them .Retail bought 45 K CE contracts and 25.3 K CE were shorted by them.

- 8000 PE OI@66.2 lakhs having the highest OI strong support at 8000. 8000-8500 PE added 15.7 Lakh in OI so strong base near 7900-8000 zone .FII bought 13.2 K PE longs and 15K PE were shorted by them .Retail bought 27.9 K PE contracts and 10.9 K PE were shorted by them.

- FII’s bought 980 cores in Equity and DII’s sold 160 cores in cash segment.INR closed at 67.45

- Nifty Futures Trend Deciding level is 8200 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8150 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8180 Tgt 8201,8225 and 8250 (Nifty Spot Levels)

Sell below 8150 Tgt 8130,8100 and 8080 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Your Predictions are really super.

sir s3 is 8080 or 7980?

its 8080 corrected thanks

Sir..how to handle weekly chopad level (8181) is getting frequently…both up & down…Thanks

2 times SL triggred not trade to be taken in a day.. After seeing a big rise market is consolidating the gains of last week so such sideways move

Welcome Ritesh. This is going to be one of the best decisions for you. Like many of us.

Just a word of caution… Spend some time understanding what is being talked.. Do paper trading for a couple of months maybe..

Don’t jump into it blindly and regret or blame later.

thanks for sharing valuable advise..

Sirji thanks a lots pls tell me is there any difference between DMA or ema or dema I am confused pls help

Plz read this http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:moving_averages

Great post, have discovered this website through Google. Your posts are very informative and insightful. I’m amateur trader, looking forward to your posts

thanks