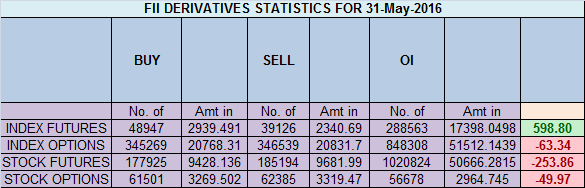

- FII’s bought 9.8 K contract of Index Future worth 598 cores ,1.3 K Long contract were added by FII’s and 8.4 K short contracts were liquidated by FII’s. Net Open Interest decreased by 7 K contract, so fall in market was used by FII’s to enter long and exit shorts in Index futures.Trading Wisdom by George Soros What is the main Reason for Your Trading Loss, We are running POLL on Twitter Please participate

- As discussed 27 April Analysis Bulls need a close above 7972 for next move till 8100/8250 Zone, High made was 8210 today so as soon as we saw close above 7972 we did the target as per GANN Cycle, Now for the June month as per Gann Analysis weekly close above 8210 we can see move towards 8577. Bearish only on close below 7972. As discussed in Yesterday Analysis 8210-8241 is crucial as its a supply zone and also PRZ zone of ABCD pattern, Unable to close above it we can see down move till 8075/8100. High made today was exactly 8210, Bulls needs a close above 8210-8241 range for next move towards 8336/8400 else correction till 8075/8000. Nifty monthly has formed Three White Soldiers pattern which is a Bullish pattern Bank Nifty continue to trade below Gann Arc,EOD Analysis

- Nifty June Future Open Interest Volume is at 2.16 core with liquidation of 0.002 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover cost @7961 closed above it

- Total Future & Option trading volume was at 1.86 Lakh core with total contract traded at 1.4 lakh , PCR @1, Trader’s Resolutions for the New Financial Year 2016-17

- 8200 CE is having Highest OI at 33.9 lakh, resistance at 8200 .8000/8500 CE bought 11.3 lakh so bears forming resistance at higher levels as nifty unable to close above 8210 .FII bought 6.1 K CE longs and 3.7 K CE were shorted by them .Retail bought 11.9 K CE contracts and 19.7 K CE were shorted by them.

- 8000 PE OI@59.7 lakhs having the highest OI strong support at 8000. 8000-8500 PE added 10.7 Lakh in OI so strong base near 7900-8000 zone .FII bought 2.4 K PE longs and 6.2 K PE were shorted by them .Retail bought 31.3 K PE contracts and 21.4 K PE were shorted by them.

- FII’s sold 114 cores in Equity and DII’s bought 60 cores in cash segment.INR closed at 67.26

- Nifty Futures Trend Deciding level is 8188 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8138 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8180 Tgt 8201,8225 and 8250 (Nifty Spot Levels)

Sell below 8150 Tgt 8130,8100 and 7980 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Plse suggest, how to get the Gunner24 crack. thanks

Great work Mr Bhandari…

nifty has formed GOLDEN CROSS after 30 month…any view sir ??

So buy na if nifty falls to 50 DMA , what else ?

shows the buying force of last 50 days is more than selling pressure of last 200 days

Dear sir,

I am a normal person please do not use these superlatives..

Rgds,

Bramesh

Don’t be so modest