- FII’s sold 6.4 K contract of Index Future worth 377 cores ,2.4 K Long contract were liquidated by FII’s and 3.9 K short contracts were added by FII’s. Net Open Interest increased by 1.5 K contract, so rise in market was used by FII’s to exit long and enter shorts in Index futures. Developing a Trading Process WHICH emotion is overpowering you the Most, To Understand the same I have put a Poll on Twitter (https://twitter.com/brahmesh), Please participate

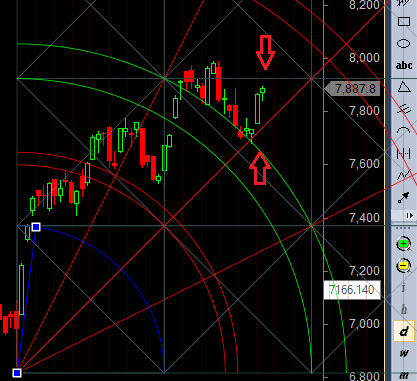

- As discussed in last analysis Gann trendline again played a crucial role and now holding 7850 we should be heading towards 7972. We need to see follow upmove above 7850 tomorrow. Nifty till holding 7850-7834 range we can see the move towards 7972/8000. Bearish only on close below 7800. Bank Nifty bounces from gann trendline,EOD Analysis

- Nifty May Future Open Interest Volume is at 1.84 core with addition of 2.6 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @7953, continue to trade below it.

- Total Future & Option trading volume was at 1.87 Lakh core with total contract traded at 1.4 lakh , PCR @0.90, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 64.8 lakh, resistance at 8000 .7500/8000 CE liquidated 5.1 lakh so bears ran for cover as Nifty closed above 7850 for second day .FII bought 3.4 K CE longs and 3 K CE were shorted by them .Retail bought 8 K CE contracts and 13 K CE were shorted by them.

- 7700 PE OI@53.5 lakhs having the highest OI strong support at 7700. 7200-7700 PE added 10 Lakh in OI so strong base near 7500-7600 zone .FII bought 13.5 K PE longs and 8.4 K PE were shorted by them .Retail bought 19.9 K PE contracts and 17 K PE were shorted by them. Retailers adding Put we might break 7950 on upside.

- FII’s bought 328 cores in Equity and DII’s bought 68 cores in cash segment.INR closed at 66.67

- Nifty Futures Trend Deciding level is 7899 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7838 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7910 Tgt 7933,7970 and 8000 (Nifty Spot Levels)

Sell below 7850 Tgt 7820,7795 and 7777 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

“Nifty May Future Open Interest Volume is at 1.84 core with addition of 2.6 Lakh with decrease in cost of carry suggesting short position were added today ”

Sirji nifty open interest is up with increase in nifty price, so doesn’t it mean long positions were added today ??

all 3 price/oi/coc to be seen