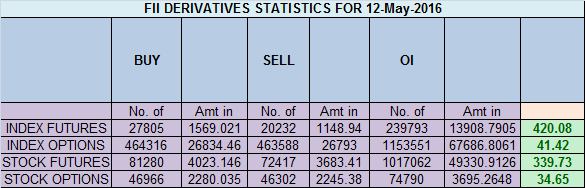

- FII’s bought 7.5 K contract of Index Future worth 420 cores ,7.1 K Long contract were added by FII’s and 0.03 K short contracts were liquidated by FII’s. Net Open Interest increased by 6.7 K contract, so rise in market was used by FII’s to enter long and exit shorts in Index futures. How to Identify Fear in Trading

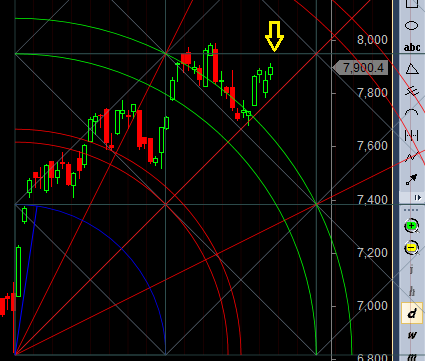

- As discussed in last analysis Nifty till holding 7850-7834 range we can see the move towards 7972/8000. Bearish only on close below 7800. Low made today was again 7849, highlighting the importance of 7850 and move up made high of 7916. So we are heading towards 7955/7972 range holding 7850, As I have been seeing we are seeing time correction On 02 May nifty closed at 7800 and today 12 May closed at 7900, so in 9 trading session we moved just 100 points, this is time correction trading in a range and eating premium of options. Bank Nifty nearing 17000,EOD Analysis

- Nifty May Future Open Interest Volume is at 1.70 core with addition of 3.2 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @7953, continue to trade below it.

- Total Future & Option trading volume was at 2.34 Lakh core with total contract traded at 1.7 lakh , PCR @0.94, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 65.4 lakh, resistance at 8000 .7500/8000 CE liquidated 2.3 lakh so bears covered what was added yesterday.FII bought 3.8 K CE longs and 0.03 K shorted CE were covered by them .Retail sold 9.9 K CE contracts and 7.1 K CE were shorted by them.

- 7700 PE OI@57.1 lakhs having the highest OI strong support at 7700. 7200-7700 PE added 6.8Lakh in OI so strong base near 7500-7600 zone .FII bought 9.5 K PE longs and 12.9 K PE were shorted by them .Retail bought 55 K PE contracts and 26.8 K PE were shorted by them. Retailers buying PE so we might break 7950.

- FII’s bought 24 cores in Equity and DII’s bought 258 cores in cash segment.INR closed at 66.61

- Nifty Futures Trend Deciding level is 7909 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7846 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7927 Tgt 7955,7972 and 7994 (Nifty Spot Levels)

Sell below 7880 Tgt 7860,7840 and 7820 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Sir,

When trading using trend changer levels, what will be the tentative targets for the trade.

Regards

K Mohan.

Please read this http://www.brameshtechanalysis.com/2013/09/nifty-futures-positional-strategy/

any views on rec ltd

Sirji ,

Open interest going up , Longs are getting build up , still PCR is at 0.94 i.e call writing is more than put writing? Any thoughts

Is PCR 0.94 or 0.964 ? any way its very close

8000 CE is wall of resistance

image not matching.

Image is of bank nifty. Can you please update it.. Will be helpful.