Infosys

Positional/Swing Traders can use the below mentioned levels

Holding 1168 Target 1200/1220

Intraday Traders can use the below mentioned levels

Buy above 1188 Tgt 1198,1210 and 1220 SL 1177

Sell below 1162 Tgt 1150,1138 and 11222 SL 1168

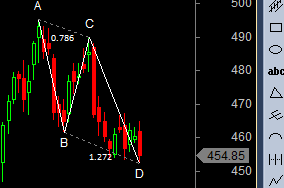

BPCL

Positional/Swing Traders can use the below mentioned levels

Holding 945 Target 975

Intraday Traders can use the below mentioned levels

Buy above 955 Tgt 959,965 and 972 SL 950

Sell below 944 Tgt 936,928 and 919 SL 948

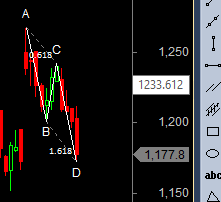

LIC Housing

Positional/Swing Traders can use the below mentioned levels

Holding 450 Tgt 475

Intraday Traders can use the below mentioned levels

Buy above 458 Tgt 462,466 and 471 SL 454

Sell below 449 Tgt 445,440 and 435 SL 453

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for April Month, Intraday Profit of 1.92 Lakh and Positional Profit of 4.61 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

bramesh, plz guide which trading software in INDIA supports harmonic trading. i know about carney harmonic analyser but it seems it does not integrate with INDIAN equity market.

I have your sent you harmonic course details