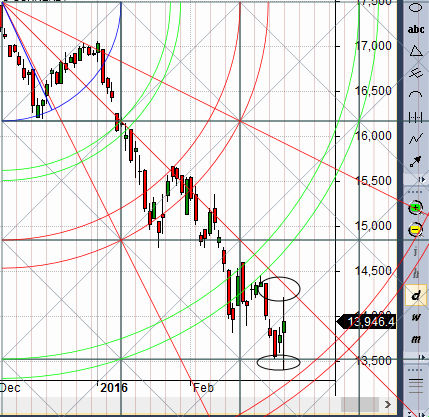

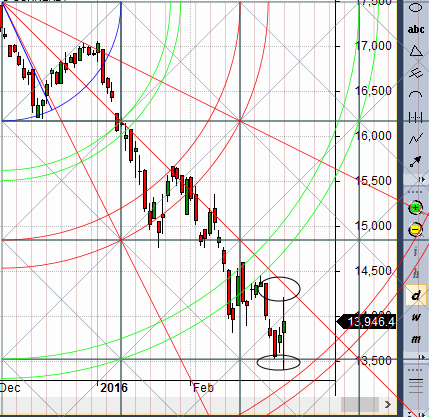

- As discussed in last analysis Now as we have budget on Monday Bank Nifty will see wide range 14272 on upside and 13500 on downside needs to be watched, closing above any one of them can see another 500 points move either side. Bank Nifty made high of 14222 and Low of 13407 in the range, So Bank Nifty broke the range on downside for 1 min but bounced back fiercely as we have gann support. Now we need a close above 14272 which is gann trend line for a 500 point run on upside else again we might see a drop to 13400-13500.Impact of the Union Budget on the Indian Stock Market

- Bank Nifty March Future Open Interest Volume is at 22 lakh with addition of 0.54 lakh with increase in Cost of Carry suggesting long positions were added today. Bank Nifty unable to close above Rollover price @14115. How To Identify Market Tops and Bottom

- 14500 CE is having highest OI @5 Lakh strong resistance formation @14500. 13500-15500 CE saw 3.2 lakh addition as bank nifty closed below 14000 and rollover price.

- 13500 PE is having highest OI @3.7 Lakh, strong support at 13500 followed by 13000, Bears added aggressively in 13000/13500 PE.13000-15500 PE saw 1.2 lakh addition. Range for March Series comes @ 13000-15500.

- Bank Nifty Futures Trend Deciding level is 13894 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 13832 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 13950 Tgt 14050,14216 and 14371 (Bank Nifty Spot Levels)

Sell below 13750 Tgt 13630,13460 and 13333 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates