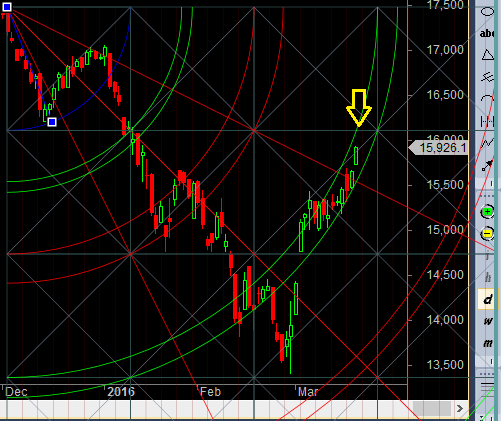

- As discussed in last analysis bank nifty was facing difficulty near 15555-15580 was due to gann resistance line, Holding the same Bank Nifty can scale towards 15800/16000 which is the next horizontal line of resistance. Bank Nifty made high of 15945 where it complete the Butterfly pattern also as discussed in Weekly Analysis Bank . Now Next 100 points range of 15945-16049 is very crucial where we will see lot of supply coming, unable to cross Bank Nifty can see 200-300 point correction. Nifty Support has increased to 15555-15600, Resistance in range of 16000-16050. Does it Hold True Let your Winners run and Cut your losses

- Bank Nifty March Future Open Interest Volume is at 23.5 lakh with addition of 1.9 lakh,10% increase in OI with decrease in Cost of Carry suggesting short positions were added today. Bank Nifty able to close above Rollover price @14115 and gave 1800 Points. How To Identify Market Tops and Bottom

- 16000 CE is having highest OI @9.3 Lakh resistance formation @16000. 14500-15500 CE saw 1.7 lakh liquidation as bears ran for cover as bank nifty is closing above 15500.

- 15500 PE is having highest OI @6.2 Lakh, strong support at 15500 followed by 15000, Bulls added aggressively in 15500/16000 PE as OI increased by 8 Lakh so bulls continue to add as Bank Nifty break the range of 15500.

- Bank Nifty Futures Trend Deciding level is 15847 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 15008 . Bank Nifty TC level gave 1000 points till now.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 16000 Tgt 16070,16200 and 16320 (Bank Nifty Spot Levels)

Sell below 15850 Tgt 15790,15680 and 15500(Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates