- FII’s bought 23.9 K contract of Index Future worth 1327 cores ,7.5 K Long contract were added by FII’s and 0.7 K short contracts were added by FII’s. Net Open Interest increased by 8.3 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. Every Success Story Is Also A Story Of Great Failure

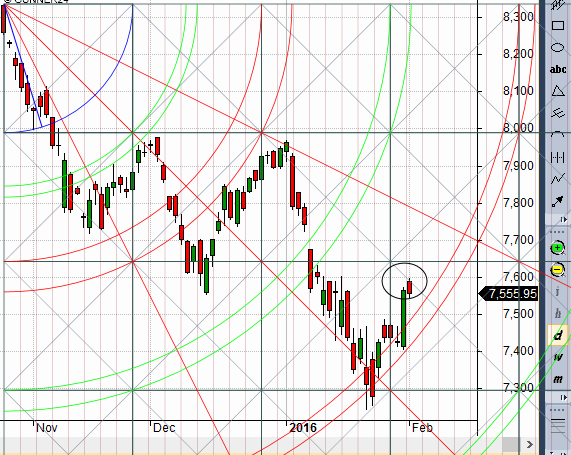

- As discussed in Last Analysis Now Bulls should watch 7593/7634 in coming 2 days as these 2 points are strong supply zone once we sustain above 7575 for 1 hour. Nifty opened with gap sustained above 7575 for 3 hours but was unable to close above the supply zone of 7593 High made was 7599 in morning and continue to trade below that level of 7593. Range of 7593-7634 is tricky range and crossing the same will take lot of efforts from bulls , Support are also rising and now near 7462/7420.Move above 7600 can see quick move till 7634/7677. Bank Nifty Technical Analysis before RBI Policy

- Nifty February Future Open Interest Volume is at 2 core with addition of 6.9 Lakh with increase in cost of carry suggesting long position were added today, Rollovers comes @67.3% and rollover cost @7419

- Total Future & Option trading volume was at 1.61 Lakh core with total contract traded at 2.7 lakh , PCR @0.91 .How To Identify Market Tops and Bottom

- 7600 CE OI at 39.6 lakh , wall of resistance @ 7600 .7400/8000 CE added 18.9 lakh in OI addition was seen by bears as nifty was not able to close above 7575 major addition was seen in 7700/7900 CE .FII bought 33.1 K CE longs and 12.7 K CE were shorted by them .Retail bought 28.2 K CE contracts and 41.5 K CE were shorted by them.

- 7400 PE OI@47.7 lakhs strong base @ 7400. 7300/8000 PE added 18 lakh so bulls used to enter lower PE strike prices as finally we closed above 7462. Fight is on for close above 7575 .FII bought 24.9 K PE longs and 9.7 K PE were shorted by them .Retail bought 7.6 K PE contracts and 6.3 K PE were shorted by them.

- FII’s bought 253 cores in Equity and DII’s sold 535 cores in cash segment.INR closed at 67.83

- Nifty Futures Trend Deciding level is 7578 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7516 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level Traders following TC levels have been handsomely rewarded with 100 points gain on first day of series.

Buy above 7575 Tgt 7593,7625 and 7650 (Nifty Spot Levels)

Sell below 7530 Tgt 7505,7480 and 7450(Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates