Last Week we gave Chopad Levels of 7246 , Nifty gave short entry on Monday and did all 3 targets on downside by Wednesday thus rewarding discipline chopad followers by 200 points. Lets analyses how to trade nifty next week as we have Union Budget on Monday. 2 Articles which traders should read before trading in Union Budget

Impact of the Union Budget on the Indian Stock Market

Option Trading Strategy for Union Budget 2016

Nifty Hourly Chart

Hourly chart trading in channel, Channel will break on Hourly close above 7141 and support at lower level comes @6830.

Nifty Harmonic

As discussed last week Now close above 7240 Tgt 7325/7450

High made 7257 but close below 7234.

Now we have probable BAT pattern forming on Nifty, Pattern BC leg will complete around 6916-6900 range if held on closing basis we can see move till 7250/7459.

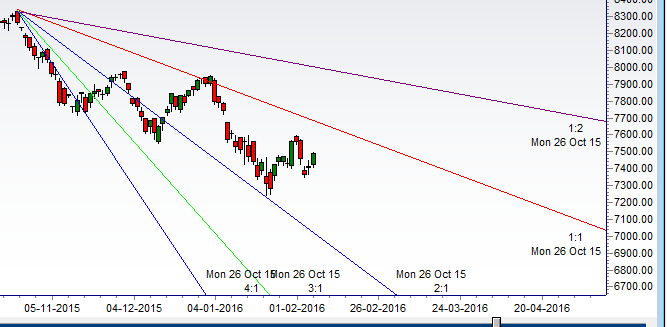

Nifty Gann Angles

Gann Angles also suggest a move till 7400

Nifty Supply and Demand

Close above 7242 om Weekly basis can target 7600.Close below 6862 we are heading towards 6638.

Nifty Gann Date

Nifty As per time analysis 29 Feb/04 March is Gann Turn date , except a impulsive around this dates. Last week we gave 24 Feb Nifty saw a volatile move.

Nifty Gaps

For Nifty traders who follow gap trading there are 6 trade gaps in the range of 7000-9000, rest all gaps were filled in the last week fall.

- 7109-7090

- 7387-7275

- 7298-7271

- 8937-8891

- 8251-8241

- 8232-8209

- 8116-8130

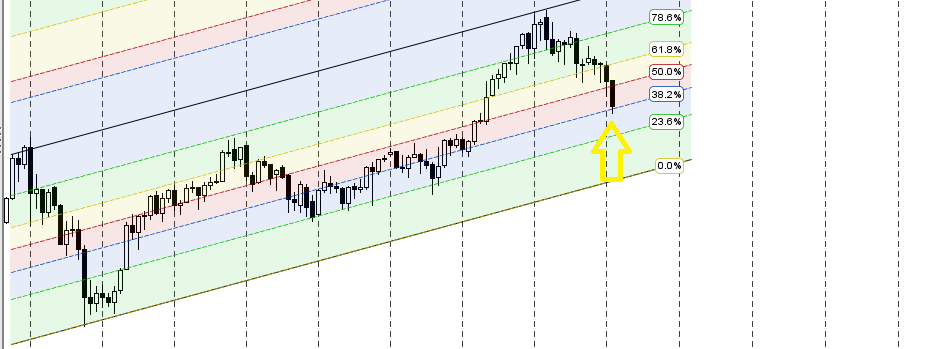

Fibonacci technique

Fibonacci Retracement

7144/7231/7318/7913/6862 levels to be watched in coming week.

Nifty Weekly Chart

It was negative week, with the Nifty down by 181 points closing @7029 reacted from gann resistance of 7232, and closing near the channel, and above its 200 WSMA, Now close above 7232 can see nifty moving to 7500-7600 range and break of 6860 can see move towards 6660.

Trading Monthly charts

Monthly chart bounced from 38.2% support.

Nifty PE

Nifty PE @19.1

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:7058

Nifty Resistance :7141,7200,7320,7416

Nifty Support :6986,6913,6830,6650

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Sir,

. The Nifty harmonic again worked out perfectly. Thanks again for the analysis. Can I learn the Nifty harmonics from you and will it be sufficient or shall I have to learn all.

Regards,

K Mohan.

You can learn master it than if needed learn others..

Sirji what exactly is the tax announced on EPF withdrawal ? Can you please throw some light ??

the Budget 2016 has proposed making 60% of employee contribution EPF corpus taxable for contributions after 1.4.2016. Till now withdrawal of EPF corpus after 5 years of continuous service was fully tax exempt. The new provisions indicates that if the EPF is not used for buying an annuity then 60% of that portion of the corpus which is built from the employee contributions made w.e.f 1.4.2016 would be taxable.

Sale on monday 7000 call nd put nd buy 6800 put nd 7200 call maximem loss up to d 60/70 point if nifty leaves at 7000 label then gets 2000 point less risky much revard in dis strge if nifty goes 7200 then quit put buy sale nd gose at 6850 then quite call buy sale

Brameshji

Typo error in nifty harmonic.

Pattern BC leg should be 6916-6900

Thanks its updated.

Bramesh Sir.

On an hourly chart mentioned above support is at 6830 instead of 7830. May be there is a typo mistake.

Regards

Sam.