Last Week we gave Chopad Levels of 7455 , Nifty gave short entry on Monday and did all 3 targets by Wednesday thus rewarding discipline chopad followers by 175 points in matter of 3 trading sessions, Nifty was unable to close above the Chopad level of 7455 throughout the week. Nifty had the worst weekly fall in past 6 years and almost corrected 24 % from the high of 9119. Lets analyses how to trade nifty next week.

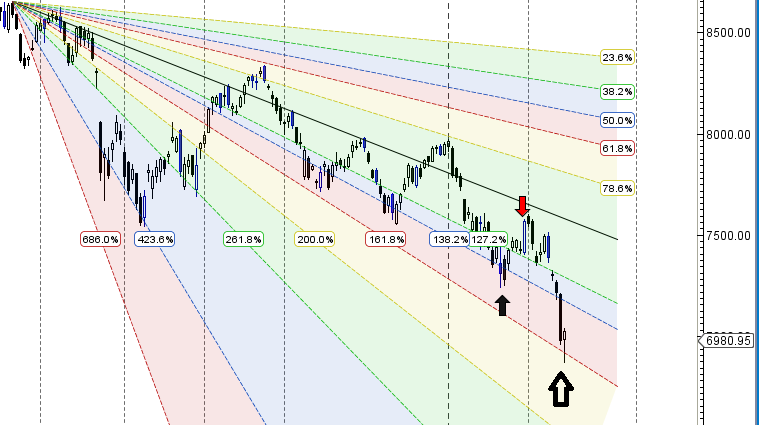

Nifty Hourly Chart

Hourly chart are trading in perfect channel as shown in above chart, so holding 6869 we can see bounceback till 7150/7250.

Nifty Harmonic

Nifty completed its black swan harmonic pattern so closing above 7043, can see move till 7151/7238.

Nifty Gann Angles

As discussed in last week Gann angles are shown above as shown we can see move till blue line.

Nifty bounced exactly from gann angles. Holding 6869 we can see move till 7150/7250

Nifty Supply and Demand

As we have been discussing in past many week till we do not close above 7563 we can see move till 7120, Market never did a weekly close above and finally the big move came till 7120,below 7120 we boucned from 6869 which was near demand zone of 6860. Coming week move above 7070 can see move till 7120/7240.

Nifty Gann Date

Nifty As per time analysis 15/19 Feb is Gann Turn date , except a impulsive around this dates. Last week we gave 08/10 Feb Nifty saw a volatile move.

Nifty Gaps

For Nifty traders who follow gap trading there are 6 trade gaps in the range of 7000-9000, rest all gaps were filled in the last week fall.

- 8327-8372

- 7298-7271

- 8937-8891

- 8251-8241

- 8232-8209

- 8116-8130

Fibonacci technique

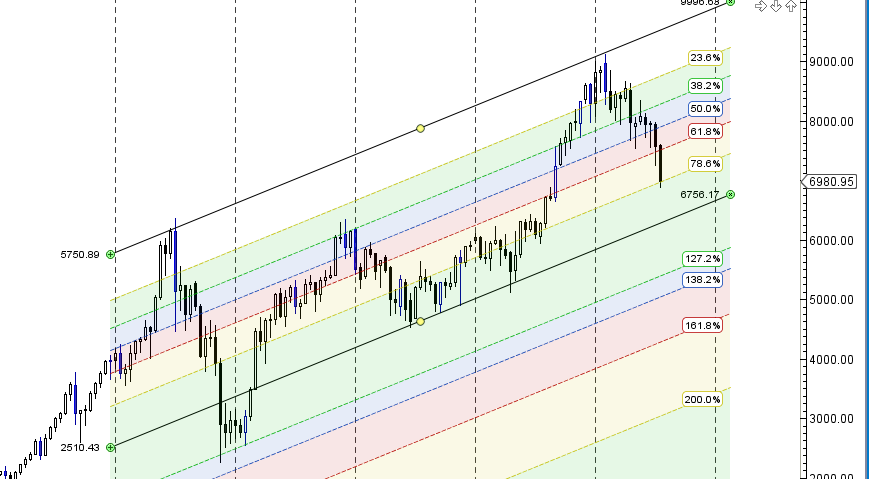

Fibonacci Retracement

Nifty moving in between the Fibo Arcs as shown above 6869/7143 are levels to be watched in coming week.

Nifty Weekly Chart

It was negative week, with the Nifty down by 508 points closing @6980 worst weekly fall in last 7 years as it moved below the middle trendline as shown in above chart and corrected till lower end and bounced from 200 W SMA, which have given good bounceback from past 3 occasion. Time Analysis also suggest we have corrected 49 week from the high of 9119, 49 is 7*7 and gann gave very important significance to number 7 so we might have formed short term bottom.

Trading Monthly charts

Monthly chart need to close above the of 78.6% @7150

Nifty PE

Nifty PE @18.67 valuation are coming to more realistic level

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:7035

Nifty Resistance :7116,7185,7263

Nifty Support :6980,6920,6856

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

LAST WEEK CHOPAD LVLS – BEST PERFORMER SO FAR ON SHORT SIDE

Bramesh sir , according to time cycle (7*7) gann theory we have made short term bottom. So can we expect a budget rally in coming 2 weeks . are we in bullish phase of Time cycle analysis?

thank you..

yes sir

Dear Brameshji, You have not mentioned gap of 7th Jan 2016. i.e. 7675-7721-41

thanks added now..

Bramesh sir please explain about option strategy gamma, beta value

sure will try to write an article

Support level 6920& 6856 ,please correct

plz post circle chart

Sir, please check support levels.typo miss