- FII’s sold 876 contract of Index Future worth 50 cores ,6.6 K Long contract were liquidated by FII’s and 5.7 K short contracts were liquidated by FII’s. Net Open Interest decreased by 12.4K contract, so fall in market was used by FII’s to exit long and exit shorts in Index futures. How to Manage Trading Stress

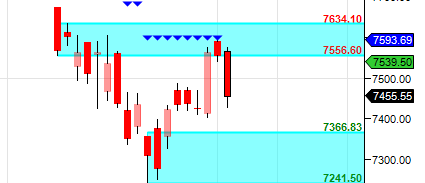

- As discussed in Last Analysis Will Nifty close above 7575 after RBI event ?Range of 7593-7634 is tricky range and crossing the same will take lot of efforts from bulls , Support are also rising and now near 7462/7420. Nifty made high of 7576 after RBI event was over and than came the fall in last 1 hour breaking the support of 7462 and closing below the support of 7462. Now we have support in the range of 7366-7380 which should be watched, for a possible bounceback as shown in gunner and supply demand chart. Bullish only close above 7575. Bearish below close of 7366. In between it can shown volatile fast move. Bank Nifty breaks gann arc,EOD Analysis

- Nifty February Future Open Interest Volume is at 1.93 core with liquidation of 7.3 Lakh with increase in cost of carry suggesting short position were closed today, Nifty closing above the Rollover cost @7419

- Total Future & Option trading volume was at 2.35 Lakh core with total contract traded at 2 lakh , PCR @1 .How To Identify Market Tops and Bottom

- 7600 CE OI at 42.3 lakh , wall of resistance @ 7600 .7400/8000 CE added 19.3 lakh in OI addition was seen by bears as nifty was not able to close above 7575 major addition was seen in 7700/7900 CE .FII bought 11.8 K CE longs and 9.3 K CE were shorted by them .Retail bought 56.6 K CE contracts and 36.7 K CE were shorted by them.

- 7400 PE OI@42.4 lakhs strong base @ 7400. 7300/8000 PE liquidated 15 lakh so bulls finally gave up as Nifty was unable to close above 7575 and closed below 7500 .FII sold 8.1 K PE longs and 9.9 K PE were shorted by them .Retail sold 1.9 K PE contracts and 1.3 K shorted PE were covered by them.

- FII’s sold 114 cores in Equity and DII’s sold 323 cores in cash segment.INR closed at 67.98

- Nifty Futures Trend Deciding level is 7533 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7520 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level Traders following TC levels have been handsomely rewarded with 100 points gain on first day of series.

Buy above 7455 Tgt 7485,7510 and 7530 (Nifty Spot Levels)

Sell below 7425 Tgt 7396,7366 and 7330 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir please email me details of your technical course

Please check once Nifty future sold amount?

Where is the confusion ? only thing is that its not nifty future, its index future ( all indices combined ), fiis reduced 6653 contracts of index future longs and 5777 contracts of index future shorts, the value stands 50.99 crore, reducing the OI from 12046 crore to 11146 crore ( reduction of 900 crore )…

sir nifty futr ya fir … nifty .. plzz coment…