Today lets discuss stock market trading systems called larry williams OOPS trading System which can be used for pattern applicable on ALL time frames, 1 minute, 5 minutes, hourly, daily, weekly, monthly or yearly stock market trading systems

History:

Back in 1979 Larry Williams published a description of a short-term trading method that is based on a pattern observed often in markets. The OOPS signal is a gap trading method that fades the direction of the opening gap. It is named thus, according to Williams, because when a broker would report to his clients that they were stopped out, he would call them and say, “Oops, we lost.”

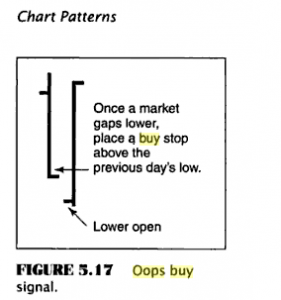

OOPS BUY

a) If you are watching daily charts, the first condition is that there has to be a SUSTAINED downtrend for a few trading sessions.I mean few Red Candles on daily Charts

b)On the last day of downtrend when the Oops buy occurs, there is a gap down, which opens well below the previous day’s low.

c)During the course of trading the stock rises and goes above the previous day’s low, and also the previous day’s close.

The above 3 steps if occurs generates an OOPS buy, with a stop loss of that day’s low.

One Practical Example:

As per the Chart Shown above all OOPS Steps are applied and We can see Suzlon Rallying to almost 30% from the OOPS Buy Generated.

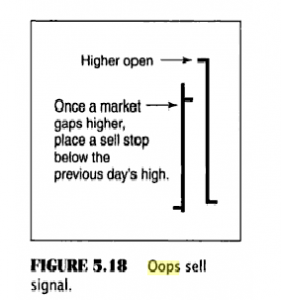

OOPS Sell

a) If you are watching daily charts, the first condition is that there has to be a SUSTAINED Uptrend for a few trading sessions.I mean few white Candles on daily Charts

b)On the last day of uptrend when the Oops sell occurs, there is a gap up opening, which opens well above the previous day’s high.

c)During the course of trading the stock corrects and goes below the previous day’s high, and also the previous day’s close.

The above 3 steps if occurs generates an OOPS sell, with a stop loss at day’s high.

Very good trading ideas, thanks!

On what pages of Williams book “How I made One Million Dollars Trading Commodities” is the OPPS trade explained? I can’t find it.

As per OOPS IDBI and TV 18 are candidate for buying

Sir according to you arvind is in oops buy

yes

Can you pls explain how arvind is exhibiting an OOPS buy. The opening on 12th is above the low of 11th?

Nifty getting close to an oops buy

Looks similar to bullish engulfing and bearish engulfing signals..

yes vikas patil is correct am afraid

OOPP !! LET US WHAT HAPPENS NOW AS PER OOPS —

Let us see what happens now as per oops –

nOW ACCORDING TO CURRENT OOPS SYSTEM THE FRESH LONG GENERATED WITH STOPLOSS 6860 FOR STRONG UPMOVE ???

Where is the gap down opening to qualify for oops buy??