Last Week we gave Chopad Level 14400 Bank Nifty Long initiated above chopad levels on Monday got stopped out but Longs Triggered as Bank Nifty closed below the chopad levels did all 3 target by Wednesday .Lets analyze how to trade Bank Nifty in coming Week as we have Union Budget on Monday. 2 Articles which traders should read before trading in Union Budget

Impact of the Union Budget on the Indian Stock Market

Option Trading Strategy for Union Budget 2016

Bank Nifty Hourly

Hourly close above the 34 EMA and channel bottom can trigger rally for 14550-14700. Bearish on close below 13500 for 13300/12800

Bank Nifty Harmonic

As discussed last week Now close above 14524 can see move towards 14745/14965. High made was 14467 so Bank Nifty did not trigger the buy level as per harmonic and corrected.

Coming week any close above 14000 bank nifty can move towards 14694.

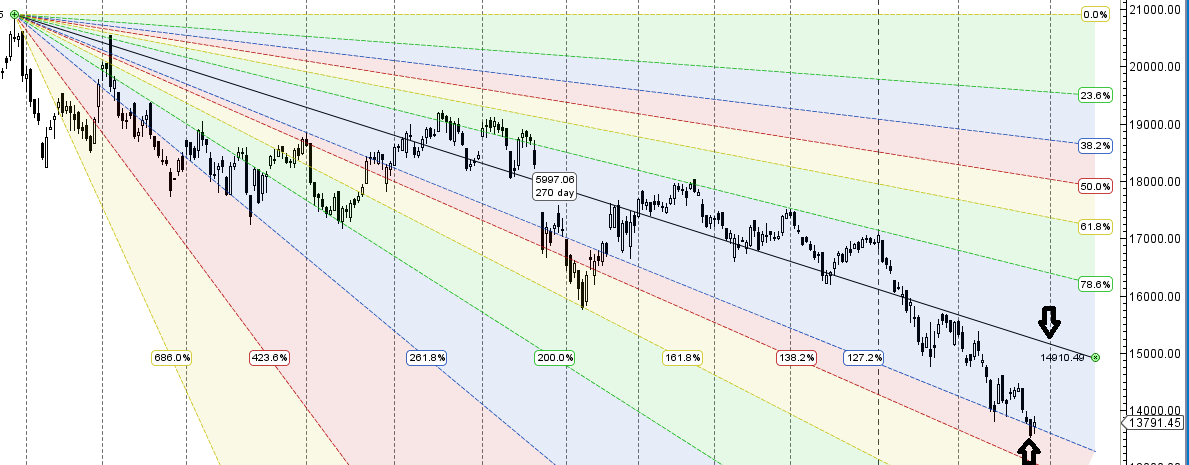

Gann Angles

As discussed last week Bank Nifty broken the gann angles and now support lies in area of 13500-13600, resistance in zone of 14500-14700.

Bank Nifty bounced from 13520 Gann Angles worked perfectly. Holding the low we can see rally till 14500/14800.

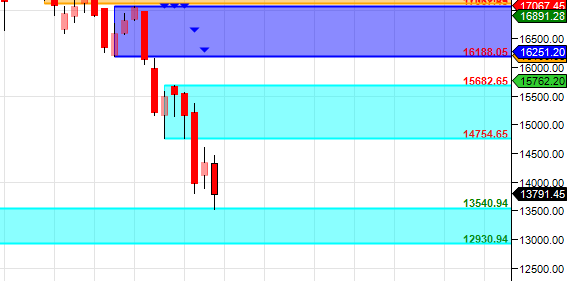

Bank Nifty Supply and Demand

Self Explanatory Chart

Bank Nifty Gann Dates

Bank Nifty As per time analysis 01/04 March is Gann Turn date , except a impulsive around this dates.

Fibonacci technique

Fibo Retracement

Fibo levels to be watched in coming week, 13981/14443/14400/14587/14771 and 13500

Bank Nifty Weekly

It was negative week, with the Bank Nifty down by 552 points closing @13791 unable to close above the lower line of AF closed just below its 200 W SMA, Close above 14000 can see fast move of 500-600 points.

Bank Nifty Monthly

Monthly chart took support at 78.6 %,Holding it bank nifty can revisit 14500/14800 as we have monthly closing.

Bank Nifty Weekly Chopad Levels

Bank Nifty Trend Deciding Level:13930

Bank Nifty Resistance:14150,14332,14500,14755

Bank Nifty Support:13760,13500,13385,13000

Levels mentioned are Bank Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh