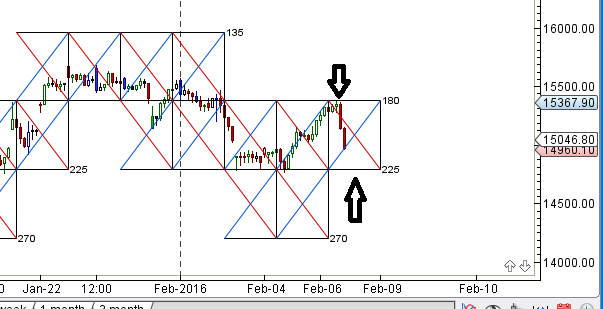

- As discussed in last analysis Bulls needs close above 15250 for next round of move till 15500/15600. Bank Nifty made high of 15367 which is pyrapoint 180 degree resistance as discussed in weekly analysis and reacted sharply from that and closing well below 15250 levels, We need to see price action near 225 Degree line at 14760 levels will it prove support again or will it breakdown this time. . Paul Tudor Jones explaining Why FAILURE is important

- Bank Nifty February Future Open Interest Volume is at 25.8 lakh with liquidation of 0.06 Lakh with decrease in Cost of Carry suggesting long positions were closed today .Bank Nifty again gave 700 points move below rollover cost @ 15441. How To Identify Market Tops and Bottom

- 16000 CE is having highest OI @8.5Lakh strong resistance formation @16000. 15500 CE saw 0.26 Lakh liquidation by bears so bears used the fall to book profit .15000-16500 CE added 0.12 Lakh in OI so no major addition was see by bears eventhough bank nifty corrected 400 points from the highs suggesting if we do not see follow up downmove we can see fast reversal. 14500-16500 looks the range for Feb series.

- 15000 PE is having highest OI @5.4 lakh, . strong support at 15000 below 14500.14500-16500 PE saw 0.62 lakh addition so bulls adding at lower strike prices,Bulls used the dips to add position,Bulls strength will be tested tomorrow.

- Bank Nifty Futures Trend Deciding level is 15255 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 15232.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Traders who took trade as per TC levels are rewarded with almost 2000 Points

Buy above 14960 Tgt 15050,15124 and 15220 (Bank Nifty Spot Levels)

Sell below 14880 Tgt 14800,14720 and 14500 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates