- FII’s sold 27 K contract of Index Future worth 1565 cores ,8.6 K Long contract were liquidated by FII’s and 18.4 K short contracts were added by FII’s. Net Open Interest increased by 9.7 K contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures.Before Taking Trades Check your state of mind

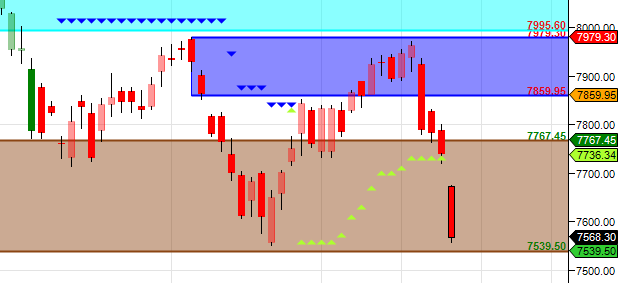

- As discussed in Last Analysis Now as per Harmonic Studies Nifty is forming CYPHER pattern which gets completed around 7641 so if 7641 holds we might see a fast and furious short covering rally. Nifty opened with gap down and was unable to hold the 7641 level and invalidated the CYPHER harmonic pattern and continued with its fall and is approaching near the swing low of 7551, break of the same we can head towards 7503 where SHARK pattern gets completed. We got the sign of fall yesterday as Nifty closed below 7767 and is almost done with the supply demand zone of target of 7540. Till we do not see close above 7767 Bulls will on back hand and bears will try to cover position in range of 7540/7503 if and when it comes. Bank Nifty did Shark Pattern final target,EOD Analysis

- Nifty January Future Open Interest Volume is at 2.15 core with addition of 7.6 Lakh with increase in cost of carry suggesting long position added today . Nifty rollover cost 7930 close below it saw sharp decline

- Total Future & Option trading volume was at 2.82 Lakh core with total contract traded at 2.22 lakh , PCR @0.87.

- 8000 CE OI at 61.1 lakh , wall of resistance @ 8000 .7600/8000 CE added 52.4 lakh in OI as bears added aggressively in 7700/7800 CE at the start of the series.FII bought 25.6 K CE longs and 20.1 K CE were shorted by them .Retail bought 63.8 K CE contracts and 24.6 K CE were shorted by them.

- 7500 PE OI@59.4 lakhs strong base @ 7500. 7500/8000 PE liquidated 15.2 lakh so bulls ran for cover .FII bought 73.8 K PE longs and 7.8 K PE were shorted by them .Retail sold 10.9 K PE contracts and 37.2 K PE were shorted by them.

- FII’s sold 1051 cores in Equity and DII’s bought 191 cores in cash segment.INR closed at 66.93

- Nifty Futures Trend Deciding level is 7615 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7826 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7600 Tgt 7640,7674 and 7700 (Nifty Spot Levels)

Sell below 7550 Tgt 7525,7503 and 7481 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

TCL — 7826 ?

Yes sir

sir,Nifty is raidy to form Short term bottom?