Bank Baroda

Positional/Swing Traders can use the below mentioned levels

Holding 134 Short term target 139/142

Intraday Traders can use the below mentioned levels

Buy above 137 Tgt 138.5,141 and 144 SL 136

Sell below 133.5 Tgt 132,129.5 and 126 SL 134.5

Dabur

Positional/Swing Traders can use the below mentioned levels

Holding 254 Tgt 267

Intraday Traders can use the below mentioned levels

Buy above 257.5 Tgt 261,264 and 267 SL 255

Sell below 253 Tgt 251,248 and 245 SL 255

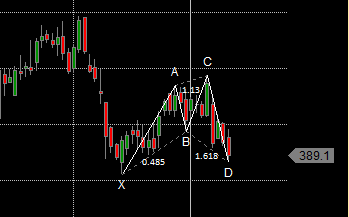

Tata Chemicals

Intraday Traders can use the below mentioned levels

Buy above 392 Tgt 396,400 and 407 SL 389

Sell below 386 Tgt 384,380 and 375 SL 388

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for December Month, Intraday Profit of 2.61 Lakh and Positional Profit of 4.48 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

When do u update intraday calls

Mostly before 9 AM.. You can like my FB page where u get immediate alert as soon as site is updted

Sir,

I watch your positional stock performance page very carefully ( Jan. 2016 ).

Please tell me this performance page you create as a aggressive trader or conservative trader ?

Its based on my trading style