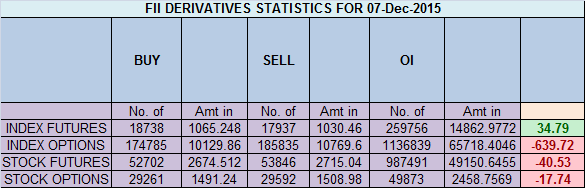

- FII’s bought 0.08 K contract of Index Future worth 34 cores ,3.2 K Long contract were liquidated by FII’s and 4 K short contracts were liquidated by FII’s. Net Open Interest decreased by 7.2 K contract, so today’s fall in market was used by FII’s to exit long and exit shorts in Index futures. Nifty Options-What happens on Expiration day?

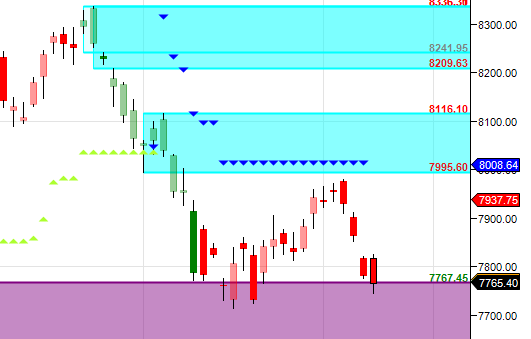

- Nifty closed tad above 7767 which is a strong demand zone, Holding the same and close above 7812 can see fast move till 7906/7995. Close below 7767 can see break of swing low of 7539. Bank Nifty holds its gann arc,EOD Analysis

- Nifty December Future Open Interest Volume is at 1.93 core with liquidation of 2 Lakh with increase in CoC suggesting short position were closed today. Nifty closing above rollover cost 7896.

- Total Future & Option trading volume was at 1.23Lakh core with total contract traded at 0.95 lakh , PCR @0.85.

- 8000 CE OI at 60.7 lakh , wall of resistance @ 8000 .7800/8200 CE added 15.8 lakh in OI as bears added position at higher level most of addition was seen in 8000/8200 CE.FII bought 4.3 K CE longs and 13.2 K CE were shorted by them .Retail bought 33 K CE contracts and 15.7 K CE were shorted by them.

- 7500 PE OI@ 53.2 lakhs strong base @ 7500. 7500/8000 PE added 0.29 lakh so bulls added no position as nifty continued with its fall .FII sold 0.03 K PE longs and 1.8K PE were by shorted them .Retail bought 6.8 K PE contracts and 4.1 K PE were shorted by them.

- FII’s sold 65 cores in Equity and DII’s sold 54 cores in cash segment.INR closed at 66.74.

- Nifty Futures Trend Deciding level is 7816 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7920 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7780 Tgt 7811,7856 and 7900 (Nifty Spot Levels)

Sell below 7746 Tgt 7732,7700 and 7655 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh