The Arms Index (also known as TRIN, an acronym for TRading INdex) was developed in 1967 by Richard Arms. It is a volume-based indicator that determines market strength and breadth by analyzing the relationship between advancing and declining issues and their respective volume. The Arms index is used to measure intraday market supply and demand, and it can be applied over short or long time periods, though it is primarily used as a short-term trading tool.

Calculation

The Arms Index is calculated by first dividing the number of stocks that advanced in price by the number of stocks that declined in price to determine the Advance/Decline Ratio. Next, the volume of advancing stocks is divided by the volume of declining stocks to determine the Upside/Downside Ratio. Finally, the Advance/Decline Ratio is divided by the Upside/Downside Ratio.

The Arms index is calculated as follows:

TRIN = (advancing issues/declining issues)

(volume of advancing issues/volume of declining issues)

Advancing Issues is the number of stocks that closed higher on the day and Declining Issues is the number of stocks that closed lower on the day. Advancing Volume is the summed volume of all Advancing Issues; Declining Volume is the summed volume of all Declining Issues.

The first part of the equation is known as the AD Ratio, or Advance/Decline Ratio. The second part of the equation is known as the AD Volume Ratio.

Interpretation

The Arms Index is primarily a short-term trading tool. The Index shows whether volume is flowing into advancing or declining stocks. If more volume is associated with advancing stocks than declining stocks, the Arms Index will be less than 1.0; if more volume is associated with declining stocks, the Index will be greater than 1.0.

A reading of 1.0 is a neutral point, and the indicator moves above and below it. Whenever the Arms Index (TRIN) is near 1.0, that means the market is at equilibrium and “all bets are off;” e.g., all trading should be avoided. Arms Index is considered bullish when it is below 1.0 and bearish when it is above 1.0. A strong up day for an index will push the TRIN down, and a strong down day for the index will push the TRIN up.

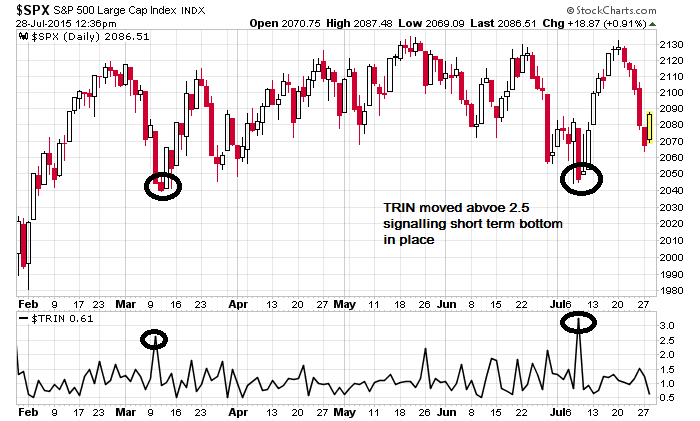

Usually a reading below 0.5 indicates a short-term top in price may be in place or close at hand and reading above 2 indicates a short-term bottom in price may be in place or close at hand

However, the Index seems to work most effectively as an overbought/oversold indicator. When the indicator drops to extremely overbought levels, it is foretelling a selling opportunity. When it rises to extremely oversold levels, a buying opportunity is approaching.

Trade using TRIN

- Overbought and Oversold

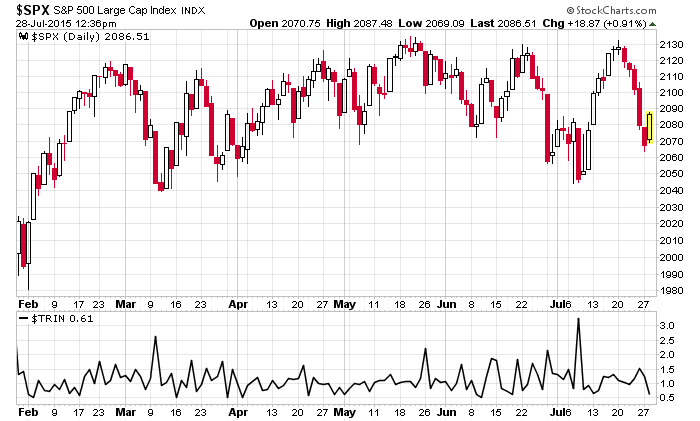

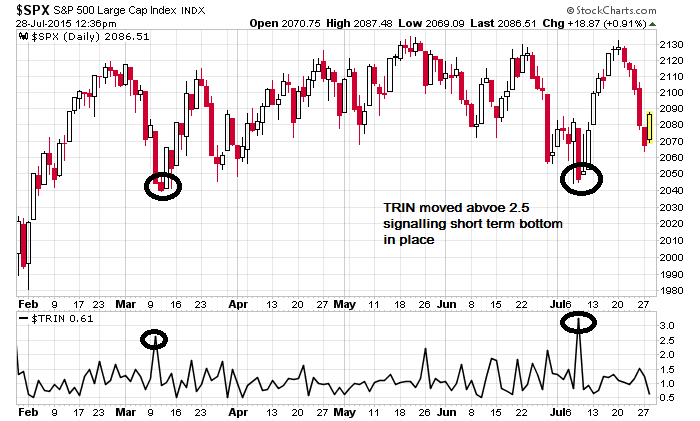

As shown in above chart,For the S&P 500 Index between Feb 2015 and July 2015, a reading of 2.0 or higher typically indicated a short-term bottom was close at hand, and the price was due for at least a bit of upside movement.

Traders following TRIN would have been able to capture short term bottom in March and June.

As shown in above chart,For the Nasdaq Index between Feb 2015 and July 2015, a reading of 0.5 or lower typically indicated a short-term top was close at hand, and the price was due for at least a bit of downside movement.

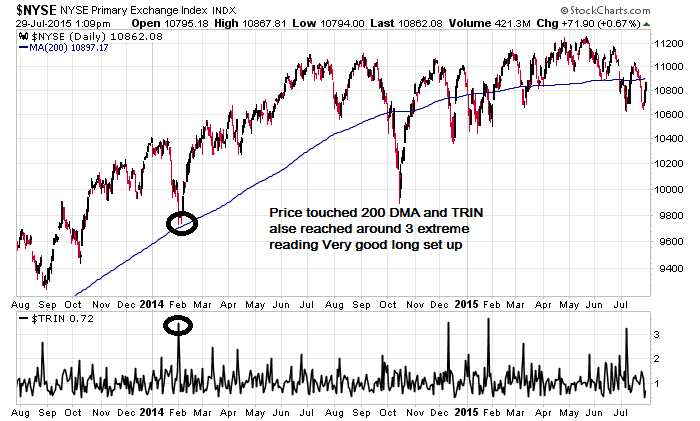

Use oversold levels on the TRIN to confirm entry points during an overall uptrend. Define the uptrend using a 200-day moving average. Look for the TRIN to reach 2.0 or higher to signal an oversold level in the price. Enter long as soon as the price starts to show strength again and the TRIN reverses back below 2.0. As shown in below chart a good Long entry set up was seen Feb 2014 when NYSE was trading near 200 DMA and TRIN reached around 3. Longs can be taken with stop loss below 200 DMA.

The same approach is applied to a downtrend. Wait for rallies in price where the TRIN reaches 0.5 or below. Once the price begins to move higher, and/or the TRIN moves above 0.5, look to enter a short position with a stop loss just above the recent high.

- Trading Breakout using TRIN

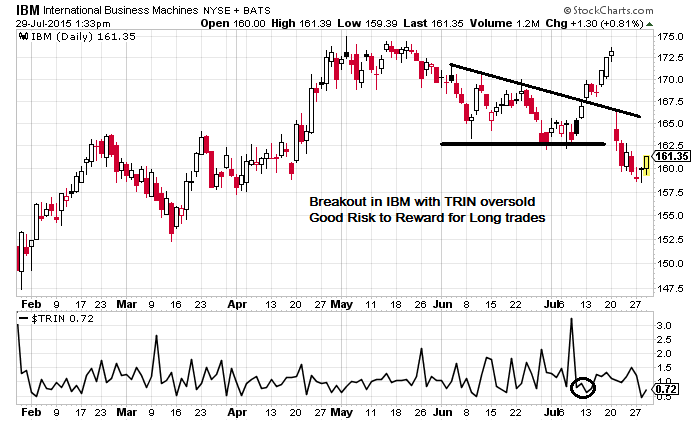

TRIN can also be used to confirm breakouts in stocks,Ideally, when the price breaks higher, the TRIN should be below 1.0 to show there is buying pressure (but not below 0.5, as that would indicate the price may be overbought). Buy when the price breaks above the pattern.

Chart below shows the price breaking above a descending triangle pattern. Just prior to the breakout the TRIN was below 1.0 showing buying pressure, and at the point of breakout the TRIN is right near 1.0. This provided enough confirmation of the buying pressure to trade the breakout.This confirmation could have been used to enter a long position. Breakouts which occur in the direction of the overall trend, is more likely to give reward.

The same concept applies to downside breakouts. TRIN is above 1.0 just prior to or at the time of breakout, and ideally the breakout is in the direction of an overall trend.

Limitation of TRIN

Overbought and oversold levels are not exact levels. The TRIN can move well beyond these extremes before a price reversal occurs. Also, just because an overbought or oversold level is reached doesn’t mean the price will reverse.

The TRIN, as described here, is predominantly a short-term indicator, used by day traders and swing traders. It can be used as a longer term indicator if the data is smoothed and averaged, say over 4, 21 or 55 periods. This can be done by applying a moving average to the indicator, and then focusing on the moving average reading. Spikes will be smoothed out over a number of days and only the strongest overbought and oversold will appear using the TRIN moving average.

Given that it is naturally a short-term indicator, it is best to use the indicator in conjunction with overall trend analysis. Isolating the broader trend is up to the trader, but using a 200- or 100-day moving average can aid in finding the trend direction.

The indicator can have erratic movements and therefore may not be an ideal indicator to use for exiting profitable positions. The strategies above focus on getting you into a trending move; once that trend move has begun another method must be employed to exit the position with a profit.

Conclusion

Using the Arms Index (TRIN) can be a very useful part of any active day (and swing) trader’s toolkit of trading indicators, when used properly. It provides immediate market breadth long-short bias that can be used to improve discipline and directional trading entry skills.

where we can this indicator on daily basis for index and stocks

Brahmeshjii kindly give us details from where we can get this TRIN charts…

Kindly answer whether TRIN charts given on http://nsetrin.blogspot.in/ can be of any help ??

Thanks

Yes this website provided TRIN on indian market

hi Bramesh Ji,

any web link to find this type of stock indicator?

regards

Kamaldeep singh

can we get this type of chart for nifty?

yes it can be used for nifty also