- FII’s bought 47.3 K contract of Index Future worth 963 cores ,33.1 K Long contract were added by FII’s and 14.1 K short contracts were liquidated of by FII’s. Net Open Interest increased by 19 K contract, so today’s fall in market was used by FII’s to enter long shorts in Index futures Secrets of Profitable Traders Part-II

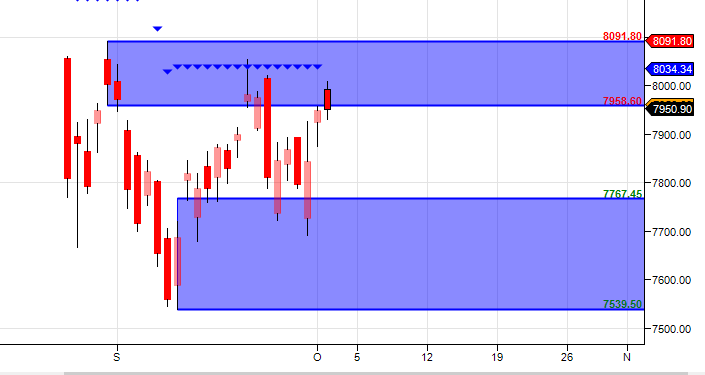

- Nifty opened with gap above 7958 but the rise was not sustainable and came down to fill gap, still unable to close above the demand zone of 7958 as shown in below supply and demand chart, close made was 7950.9 Closing above 7958 we can see move towards 8050/8091 and unable to cross that we can see move back to 7850/7767.

- Nifty October Future Open Interest Volume is at 1.90 core with addition of 4.3 Lakh with decrease in CoC suggesting short position were added today. Rollover cost @7940 for October series, Nifty Future finally closed above it.

- Total Future & Option trading volume was at 1.58 Lakh core with total contract traded at 4.6 lakh . PCR @0.96 Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- 8300 CE OI at 41.8 lakh , wall of resistance @ 8300 .7700/8200 CE added 8.5 lakh in OI so bears added today . FII bought 13 K CE longs and 29.8 K shorted CE were covered by them.Retail bought 26.5 K CE contracts and 47.3 K CE were shorted by them.

- 7500 PE OI@ 48.2 lakhs strong base @ 7500. 7600/8200 PE added 6.1 lakh so bulls also adding in 7800/7700 PE making base stronger at lower level. FII sold 45.9K PE longs and 2.7 K PE were shorted by them .Retail bought 59.1 K PE contracts and 10.5 K PE were shorted by them. Retailers going short and FII bias turning bullish.

- FII’s bought 48 cores in Equity and DII’s bought 152 cores in cash segment.INR closed at 65.51 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 7992 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7906 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7964 Tgt 7994,8015 and 8040 (Nifty Spot Levels)

Sell below 7920 Tgt 7897,7875 and 7844 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hello bramesh Sir

Elliote wave theory is better or gann theory ? Which one has more accuracy

All theory gives good results if followed them religiously with discipline

Fight was good between bears and bulls 8000 call has 40 lac open int while 8000 put has 20 lac need to add more in put for bullish swing , bulls hold 7900 level