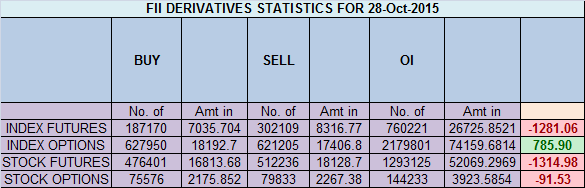

- FII’s sold 114 K contract of Index Future worth 1281 cores ,125 K Long contract were liquidated by FII’s and 10.2 K short contracts were liquidated by FII’s. Net Open Interest decreased by 135 K contract, so today’s fall in market was used by FII’s to exit long and exit majority shorts in Index futures How to Build Confidence as a Trader

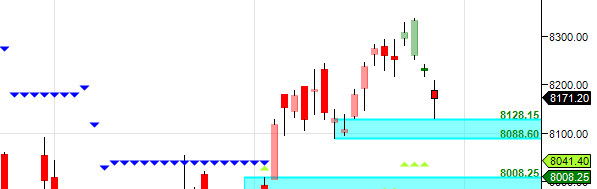

- As discussed yesterday Nifty high at 8336 was exactly at gann angle drawn from the high of 9119, we have got sell off in past 2 occasion once nifty touched this angle as shown in below gann chart. Today close was near support zone break below it can see nifty going towards 8128/8150 range. Gann Analysis worked again as Nifty continues its correction, today was 3 days of correction, as nifty opened below the demand zone of 8217 and corrected all the way to 8131 near our demand zone of 8128 and bounced back, As we have expiry tomorrow Nifty needs to hold 8128 unable to do so we can correct all the way till 8088/8041. Holding 8128bounceback till 8200/8244 possible. Bank Nifty October Expiry Analysis

- Nifty October Future Open Interest Volume is at 1.06 core with liquidation of 17.7 Lakh with increase in CoC suggesting short position were closed today.Rollover stands at 51% and Rollover cost @8294

- Total Future & Option trading volume was at 4.28 Lakh core with total contract traded at 5.4 lakh . PCR @0.92. Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- 8300 CE OI at 53.5 lakh , wall of resistance @ 8300 .8200 CE added 8 lakh in OI so bears adding position at 8200 and want to have expiry below 8200. FII sold 44.1 K CE longs and 11.8 K shorted CE were covered by them.Retail bought 122 K CE contracts and 35.3 K shorted CE were covered by them.Retailers going Bullish bias on expiry day.

- 8100 PE OI@ 43.5 lakhs strong base @ 8100. 8200 PE liquidated 21 lakh so bulls ran for cover as 8200 was broken . FII bought 22.3 K PE longs and 16.6 K shorted PE were covered by them .Retail sold 135 K PE contracts and 73.4 K shorted PE were covered by them.

- FII’s sold 731 cores in Equity and DII’s bought 160 cores in cash segment.INR closed at 64.92.

- Nifty Futures Trend Deciding level is 8186 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8134 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8180 Tgt 8200,8220 and 8248 (Nifty Spot Levels)

Sell below 8130 Tgt 8105,8088 and 8055 (Nifty Spot Levels)

Upper End of Expiry:8244

Lower End of Expiry:8098

Click Here to Like Facebook Page get Real time updates