- FII’s sold 4.7 K contract of Index Future worth 624 cores ,29.1 K Long contract were liquidated by FII’s and 24.4 K short contracts were liquidated by FII’s. Net Open Interest decreased by 53.6 K contract, so today’s fall in market was used by FII’s to exit long and exit majority shorts in Index futures Do you want to be The “Perfectionist” in trading ?

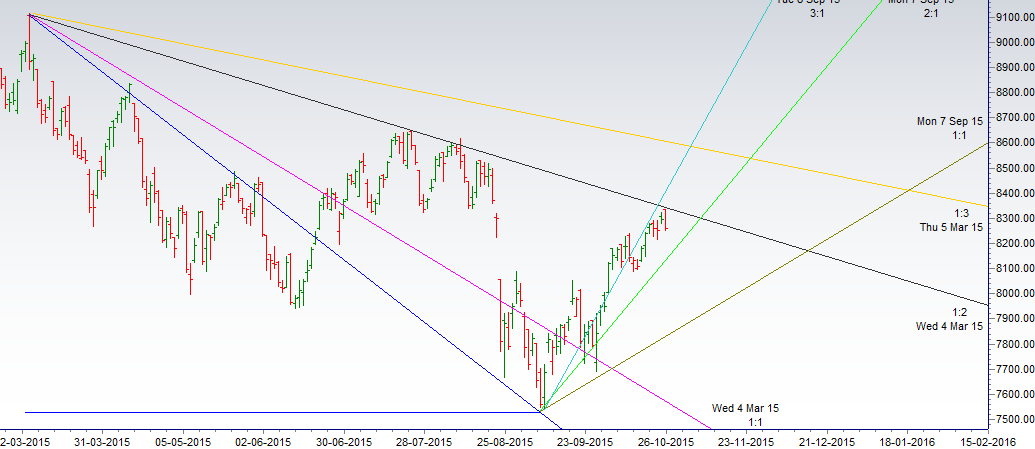

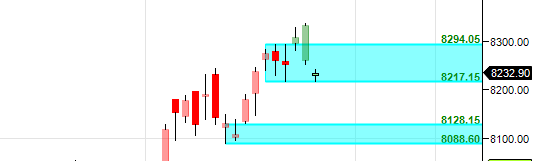

- Nifty traded in lowest range in past many years, range was just 30 points as we have Lot sizes increase coming from November expiry so traders are using the low volatile and range bound move to liquidate positions. Nifty high at 8336 was exactly at gann angle drawn from the high of 9119, we have got sell off in past 2 occasion once nifty touched this angle as shown in below gann chart. Today close was near support zone break below it can see nifty going towards 8128/8150 range. Bank Nifty near support zone,EOD Analysis

- Nifty October Future Open Interest Volume is at 1.51 core with liquidation of 17.5 Lakh with increase in CoC suggesting short position were closed today.Rollover stands at 36% and Rollover cost @8317

- Total Future & Option trading volume was at 2.84 Lakh core with total contract traded at 3.8 lakh . PCR @0.86. Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- 8300 CE OI at 47.8 lakh , wall of resistance @ 8300 .8000/8400 CE liquidated 15.4 lakh in OI so bears used the fall to cover their position. FII sold 77.3 K CE longs and 29.8 K shorted CE were covered by them.Retail sold 10 K CE contracts and 50.3 K shorted CE were covered by them.

- 8200 PE OI@ 49.3 lakhs strong base @ 8200. 8200/8400 PE liquidated 7.8 lakh so bulls used the fall to exit an early indication 8200 can breaks . FII sold 27.3 K PE longs and 5.8 K shorted PE were covered by them .Retail sold 52.8 K PE contracts and 37.1 K shorted PE were covered by them.

- FII’s bought 9 cores in Equity and DII’s sold 165 cores in cash segment.INR closed at 64.95.

- Nifty Futures Trend Deciding level is 8241 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8132 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8230 Tgt 8250,8270 and 8300 (Nifty Spot Levels)

Sell below 8215 Tgt 8195,8175 and 8150 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Today was cakewalk for most traders…

super hit

dear sir now fethar up move start..?

Very Importantly, FII have been selling stock futures for quite long now. They always book losses in Index futures, as they make huge profits in Nifty options.

Net on Net FII’s have sold, they covered more shorts as compared to liquidation of longs hence the fii figure is in green, Devil lies in details

Correct FII BOUGHT INDEX FUTURES