- Gann Analysis worked again as Nifty continues its correction, today was 4 days of correction, as nifty broke 8131 and corrected all the way to 8098 which was lower end of expiry range and near our demand zone of 8088, Nifty needs to hold 8088 unable to do so we can correct all the way till 8041/8000. Holding 8088 bounceback till 8200/8244 possible.We have lot size increase taking effect from tomorrow, Nifty lot size is changing from 25 to 75, For other lot size please click on this link Bank Nifty October Expiry Analysis

- Nifty November Future Open Interest Volume is at 1.78 core with addition of 42 Lakh with increase in CoC suggesting long position were added today.Rollover stands at 62% and Rollover cost @8269

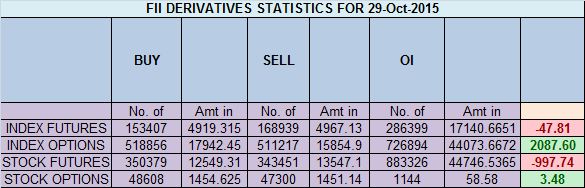

- Total Future & Option trading volume was at 5.16 Lakh core with total contract traded at 4.8 lakh . PCR @0.88. Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- FII’s bought 174 cores in Equity and DII’s sold 299 cores in cash segment.INR closed at 65.3

- Nifty Futures Trend Deciding level is 8165 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8165 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8130 Tgt 8160,8190 and 8211 (Nifty Spot Levels)

Sell below 8097 Tgt 8080,8050 and 8000 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Nifty might urrest the fall today… And close on a positive note. New lot sizes would boost up cash volumes.. As more retail traders would to move to cash

Thank you. You are doing a great job, day in and day out. God bless your tribe.

Hello…. How to calculate the rollover cost.. 8269

covered in my trading course