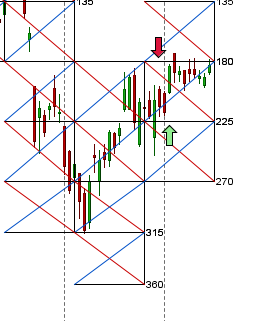

- Bank Nifty Opened with gap up and tried to move above the resistance zone of 17750 where we have multiple top but again made a high of 17752 and fall back,As shown in gann box chart bank nifty was unable to move above 1×1 line and pyrapoint chart also unable to close above 180 degree angle, continuing with its consolidation mode .17850 is breakout area for 18050/18144 and 17350 is breakdown area for 17177/17000, In between its pure consolidation mode. The ‘formula’ for trading Success :Consistency

- Bank Nifty October Future Open Interest Volume is at 23.4 lakh with addition of 1.24 Lakh with increase in CoC suggesting long position were added today. Rollover cost @17334, and bank nifty closed above it but near rollover price.

- 18000 CE OI at 6.3 lakh with liquidation of 0.40 lakh suggesting , wall of resistance @ 18000 .17500 CE liquidated 0.28 lakh so bears liquidated positions in 17500 CE. 17000-18000 CE liquidated 0.89 Lakh, so Bears liquidated position which were added yesterday.

- 17000 PE OI@ 6.1lakhs strong base @ 17000. 16500/17000 PE liquidated 0.84 lakh so bulls are still not confident bank nifty can cross 18000. 16000/17000 PE liquidated 0.90 lakh.

- Bank Nifty Futures Trend Deciding level is 17750 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 17543 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 17770 Tgt 17850,17930 and 18055 (Bank Nifty Spot Levels)

Sell below 17590 Tgt 17504,17400 and 17200 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

bnf will get res at 18021 and overshoot target 18071 comming days

Name of 11 banks have cropped up related to black money transastions.Do u think it will have negative impact on banking stocks and BNF?

Need to analyze the news,still details are awaited,

Rgds,

Bramesh

Thanks