- FII’s sold 3.4 K contract of Index Future worth 88 cores ,28.5 K Long contract were added by FII’s and 18.6 K short contracts were added by FII’s. Net Open Interest increased by 85 K contract, so today’s fall in market was used by FII’s to enter long in Sep Series and enter shorts in Aug Series index futures .Improve Futures Trading Success

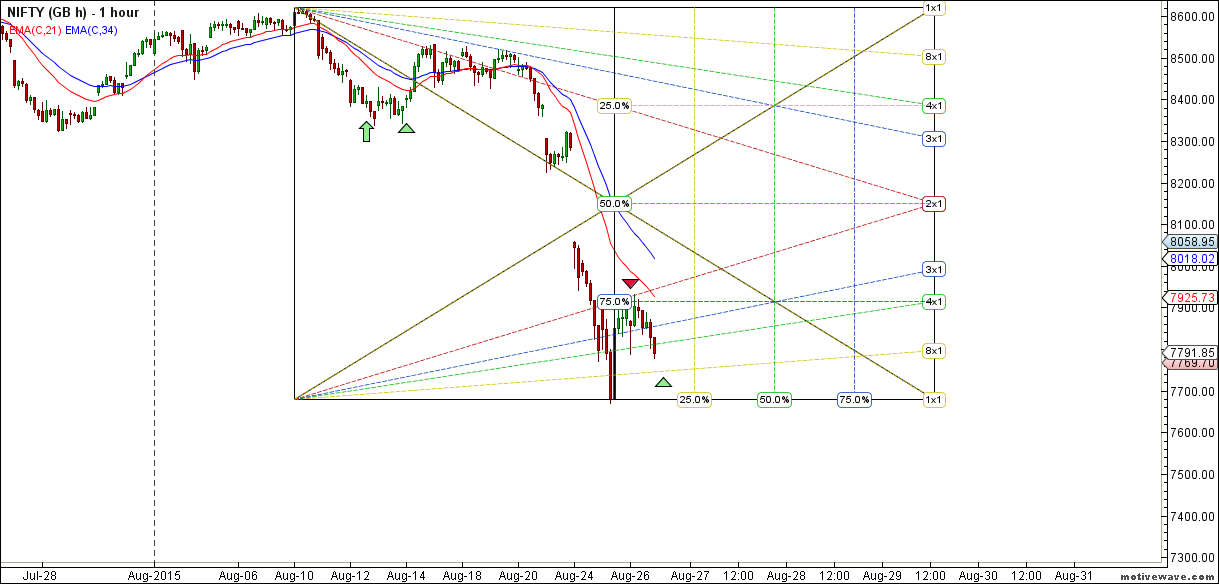

- Nifty opened with gap down saw a swift recovery to fill the gap and than fall in end session.Nifty got resisted at 2×1 line of gann box as shown below and saw the decline.7930/7940 will act as important resistance going forward.Support as per gann box suggests 7747 and below that we can revisit the low of 7667 formed on Tuesday. Pyrapoint suggests good move can be seen breaking of 180/225 degree line.Traders in pain will be subjected to more pain.

- Nifty August Future Open Interest Volume is at 1.49 core with liquidation of 19 Lakh and addition of 43 lakh in Sep future Rollover stand at 59 % and avg cost of rollover @ 8009.

- Total Future & Option trading volume was at 4.45 Lakh core with total contract traded at 7.5 lakh . PCR @0.84.

- 8000 CE OI at 45.2 lakh , wall of resistance @ 8000 .7800/8000 CE added 26 lakh in OI so bears added major position today in 7900/ 8000 CE. FII bought 28.5 K CE longs and 85 K CE were shorted by them.Retail bought 172 K CE contracts and 14 K CE were shorted by them.

- 7800 PE OI@ 35 lakhs strong base @ 7800. 7900/800 PE liquidated 9.6 lakh so major liquidation was seen in 8000/7900 PE bulls unable to move above 7940 and selling pressure came again . FII bought 18.6 K PE longs and 3.8 K PE were shorted by them.Retail bought 4.9 K PE contracts and 47.4 K PE contracts were shorted by them.Retailers buying CE and market going down.

- FII’s sold 2.3 K cores in Equity and DII’s bought 1.8 K cores in cash segment.INR closed at 66.15 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 7858 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8403 and BNF Trend Deciding Level 17024 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18470 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7835 Tgt 7888 ,7930 and 7980 (Nifty Spot Levels)

Sell below 7775 Tgt 7740,7720 and 7680 (Nifty Spot Levels)

Upper End of Expiry:7895

Lower End of Expiry:7687

Click Here to Like Facebook Page get Real time updates

Sir, how to get Pyrapoint and Gann automated? thanks in advance

Sir your NF trend changer reaped good profit & saved me from whipsaws this series…. Thanks a lot..

njoy

sir ji you said in time analysis that bullish cycle will be there but this is completely reverse. what should do now should buy or sell or not to trade ???

As per Risk Management 8000 was broken and we should aviod buying till NIfty closed above 8000.

Rgds,

Bramesh

thanks sir very prompt and clear view .

Thank you sir

Nice blog and excellent data analysis, Mr. brahmesh.

Not sure what you mean when you say, more pain for traders in pain …

Please clarify

Traders who are holding shorts will be subjected to more pain.