- FII’s bought 116 K contract of Index Future worth 2512 cores ,104 K Long contract were added by FII’s and 11.5 K short contracts were liquidated by FII’s. Net Open Interest increased by 93.2 K contract, so today’s rise in market was used by FII’s to enter long and square off shorts in index futures .Japan’s Legendary “Twitter Trader” Reveals The Secret Of His Multi-Million Dollar Success

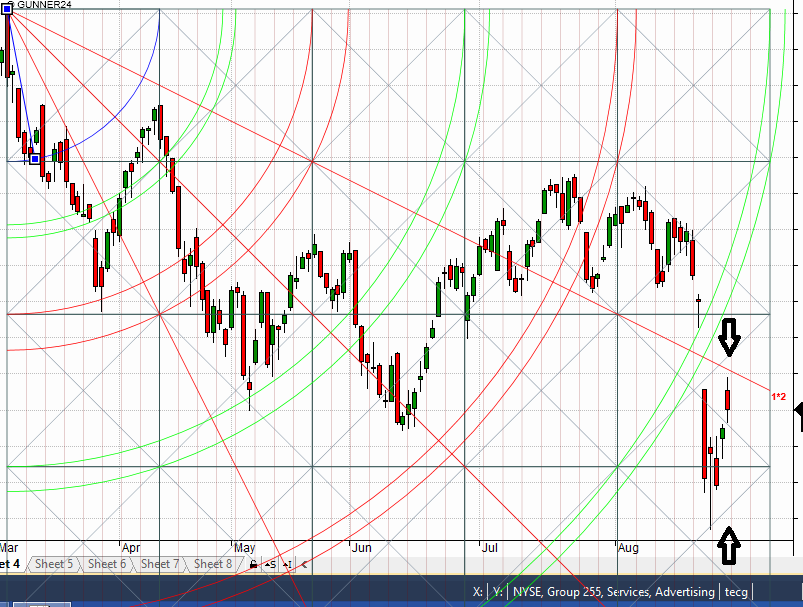

- Nifty saw correction of 834 points in 4 trading sessions, saw a pullback of 424 points in 4 trading session and retraced 50% of the fall. Going forward Nifty has to cross important gann resistance line of 1*2 as shown in below chart for bigger retracement.7948-7961 is important zone of support below that we can see market moving to sub 7800 zone. We were able to capture today’s low as per Demand and Supply analysis, Demand zone of 7664 and Nifty made low of 7667 and bounced back

- Nifty September Future Open Interest Volume is at 2.19 core with addition of 9.4 Lakh with fall in OI suggesting short position have been added. Rollover stand at 65 % and avg cost of rollover @ 7998.

- Total Future & Option trading volume was at 1.9 Lakh core with total contract traded at 6.7 lakh . PCR @0.93.

- 8200 CE OI at27.7 lakh , wall of resistance @ 8200 .7900/8200 CE added 14.6 lakh in OI so bears added minor position today in 8100/8200 CE. FII bought 88.9 K CE longs and 93.9 K CE were shorted by them.Retail bought 19.7 K CE contracts and 1115 K CE were shorted by them.

- 7800 PE OI@ 43 lakhs strong base @ 7800. 7900/8100 PE added 12 lakh so major addition was seen in 8000/7900 PE by bulls . FII bought 182 K PE longs and 27.8 K PE were shorted by them.Retail bought 61.9 K PE contracts and 115 K PE contracts were shorted by them.

- FII’s bought 56 cores in Equity and DII’s bought 847 K cores in cash segment.INR closed at 66.16 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 8055(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8004 and BNF Trend Deciding Level 17430 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17350 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8020 Tgt 8050,8090 and 8120 (Nifty Spot Levels)

Sell below 7960 Tgt 7945,7920 and 7888 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir nearly 1000 point difference in bank nifty TC level between 28th and 31st.what is the correct level? Please clarify.

If Holding 7960 then more upside? Also mention supply zone for this upmove!

Thanks in advance

Hi Bramesh,

“We are still in Bullish time cycle from 14 June till mid September, correction in between should be bought into with proper risk management.”

Can you please explain on the above…does it mean after mid sept is it going to be bearish cycle? if yes, how long is it going to be?

Sir, BNF Trend changer level was 17265 on 28-8-15.But now you have mentioned it as 18350 today.Is it 18350 or 17350

17350