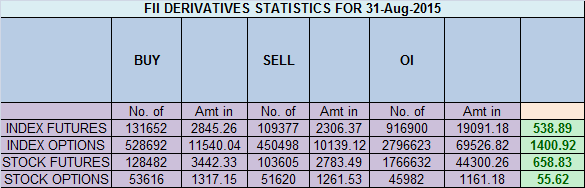

- FII’s bought 22 K contract of Index Future worth 538 cores ,28.7 K Long contract were added by FII’s and 6.5 K short contracts were added by FII’s. Net Open Interest increased by 35.2 K contract, so today’s fall in market was used by FII’s to enter long in NF and enter shorts in BN futures .Trading Mantra for New Traders

- We have been discussing in previous analysis 7948-7961 is important zone of support below that we can see market moving to sub 7800 zone. Low formed today was 7947 and nifty saw recovery from 7947. Nifty has formed lower high and lower low formation and after big fall is showing sign of consolidation. August was the bad month in past 4 years as nifty corrected by almost 6% highest in past 4 years. Break of 7947/7920 range can see nifty correcting sub 7800. Bullish only above 8100.

- Nifty September Future Open Interest Volume is at 2.21 core with addition of 1.2 Lakh with rise in OI with rise in CoC suggesting long position have been added. Rollover stand at 65 % and avg cost of rollover @ 7998.

- Total Future & Option trading volume was at 1.43 Lakh core with total contract traded at 5.3 lakh . PCR @0.92.

- 8200 CE OI at 29.5 lakh , wall of resistance @ 8200 .7900/8200 CE added 7.7 lakh in OI so bears added minor position today in 8100/8200 CE and added 22 Lakh. FII bought 22.7 K CE longs and 25.1 K CE were shorted by them.Retail bought 49.8 K CE contracts and 47.4 K CE were shorted by them.

- 7800 PE OI@ 45.7 lakhs strong base @ 7800. 7900/8100 PE added 10 lakh so major addition was seen in 8000/7900 PE by bulls . FII bought 103 K PE longs and 23 K PE were shorted by them.Retail bought 42.5 K PE contracts and 79.7 K PE contracts were shorted by them.

- FII’s sold 551 cores in Equity and DII’s bought 478 cores in cash segment.INR closed at 66.48 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 8007(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8005 and BNF Trend Deciding Level 17262 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17320 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7990 Tgt 8025,8045 and 8080 (Nifty Spot Levels)

Sell below 7970 Tgt 7950,7932 and 7900 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Thank You, Sir

A quick analysis on deliverable trades reveals that Stocks with exposure to weak rupee had lot of delivery based buying today. This is a sign of sector rotation and also index management. We may see a narrow range on weekly basis till the fed rate hike nears. Time for some contraction before we expand again. Bramesh can throw more light on the this using technical indicators. My view is that we are going into a trading range between 8150 and 7850 for three weeks.. Market Makers may not want to break 7600 levels because it will open downsides to 6600. Can Bramesh throw some light on the medium term monthly chart?

September month market will remain volatile, if you are trader trade as per TC levels and do not try to predict range and short term bottom .

Rgds,

Bramesh

Thank you bramesh ji