Last week we gave Chopad Levels of 8627 , Nifty got stopped out on long side and rewarded chopad followers on downside meeting 2 targets. Lets analyze how to trade market in coming week as we have many index heavyweight declaring results.

Nifty Hourly Chart

Nifty hourly chart with gann box is shown above, breakout comes above 8665 and support exits near 45 degree gann line around 8460/8480 odd levels.

Nifty Hourly Elliot Wave Chart

Hourly charts on Elliot wave shows are showing upside possibility, upside move can be seen till 8884/8900 once 8665 is crossed and sustained. Break down below 8460 can see nifty moving near 8400/8370 odd levels.

Nifty Pyrapoint Analysis

This is what we discussed last week As per Pyrapoint Analysis 8650 needs to be crossed and sustained for move in next quadrant and move towards 8787/8800 odd levels.Support at 8500

Low made was 8498 and High 8654 both in pyrapoint range, Now 8500/8460 range should be watched for further move.

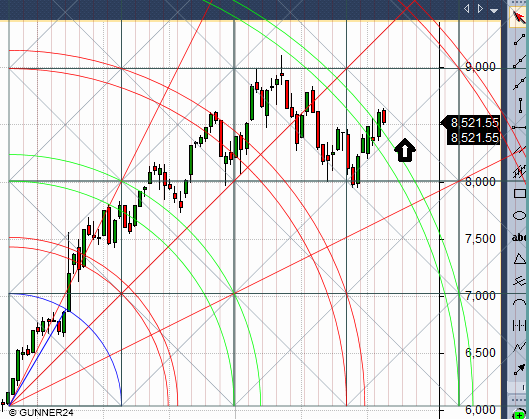

Nifty Gunner

Nifty Gann Box

Gann Box on daily chart is shown above suggesting resistance in range of 8690/8700 levels.Strong support at 2×1 line at 8535 closed below support zone, need to see if we see follow downmove.

Nifty Daily Elliot Wave Chart

As per EW more legs are left to the rally use dips around 8000/7900 to take exposure to quality large and mid caps stocks. NO leveraged positions this for cash market traders.

Traders who bought must have bee rewarded.

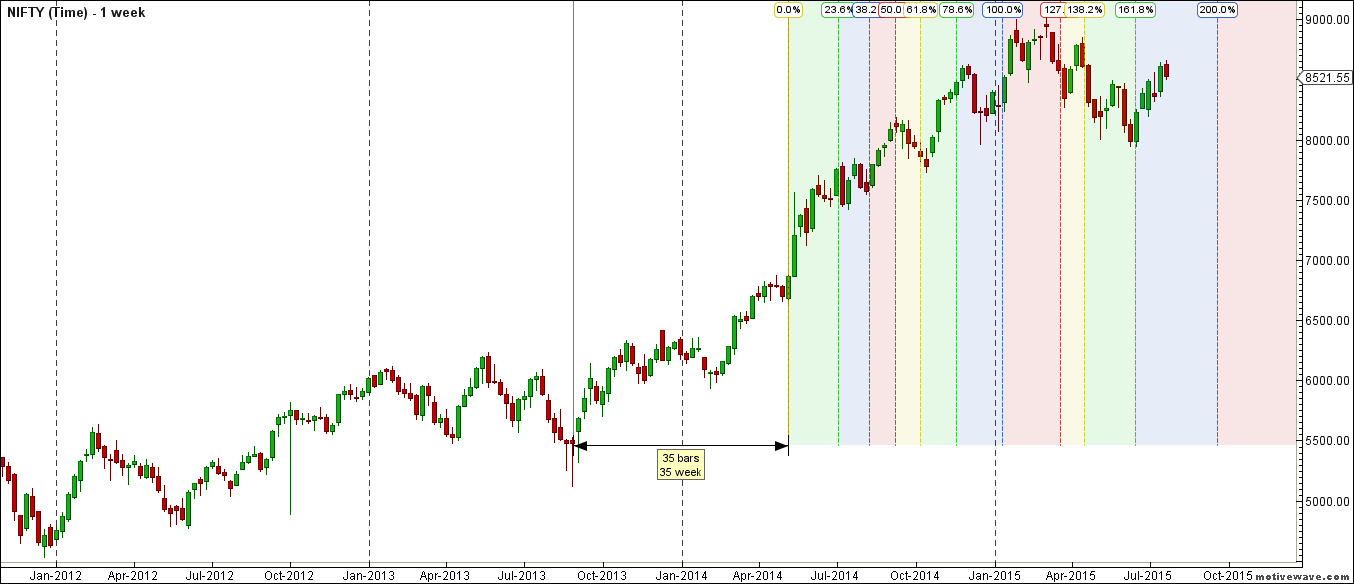

Nifty Gann Date

Nifty As per time analysis 27 July/01 August is Gann Turn date , except a impulsive around this dates. Last week we gave 24/27 July Nifty saw a volatile move .

Nifty Gaps

For Nifty traders who follow gap trading there are 15 trade gaps in the range of 7000-9000

- 7067-7014

- 7130-7121

- 7276-7293

- 7229-7239

- 7454-7459

- 7526-7532

- 7598-7568

- 7625-7654

- 7780-7856

- 7927-7940

- 8174-8195

- 8091-8102

- 8454-8462

- 8523-8542

- 8937-8891

Fibonacci technique

Fibonacci fan

61.8% again added as resistance as shown above.

8500/8527/8652/8665/8845 is fibo retracement as shown above are important level to be watched in coming week

Nifty Weekly Chart

It was negative week, with the Nifty down by 88 points closing @8521, and closing above its 20/55 WEMA and unable to cross its trendline resistance as shown in above chart. Time Analysis of showing positive move after 14 June worked perfectly

Weekly Gunner

Gunner weekly charts reacted perfectly resistance @grey line as shown in above chart.Support at green arc

Trading Monthly charts

Monthly chart after 2 Month of hammer candlestick, bullish till 8370 is held.

Nifty PE

Nifty PE @23.67 is heading in result season with expensive valuation, lets see what result season has in store to justify these hefty valuation.

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:8500

Nifty Resistance:8556,8617,8714

Nifty Support:8461,8402,8350

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Sir,

Today you did not give Nifty Future trend changer level.

Regards,

K Mohan.

8477

everything is going on rbi policy on august only till then chopped and side way movement only

Generally people with opinions about the market are very poor traders. Let mkt decide the course and just ride it

WORDS OF WISDOM FROM EXPERIENCE

UR SUCCESS DEPENDS ON HOW CLOSE U CAN RIDE WITH TREND

Good analysis bramesh

Like to read ur post

Tankx sir for update

Hi Bramesh,

Please post your views about Nifty July-2015 expiry levels.

Thanks sir,

My upper side target for nifty was 8900 but at this time it is not possible .now my target on lower side is 7940 that too it will touch very fast( before 6th august)

Thank you …..

Sir,

Please update time analysis.

Regards,

Shankar

Nifty expiry willb at 8300 or 8600

Respected Sir,

Every time i asked how can i used weekly chopped levels? What is S.L?How TSL is used? How can i trade in gap up/down opening? Suppose in this week market not reached 8500 level then how can i take position….

Hoping this time you solve all this my query….

THANK YOU SIR

I have mentioned many time Buy above chopad level book out at R and vice versa for Sell. We keep SL of 20 points or EOD clsoe depending upon market situation. Traders following should plan trade according to their risk management .

Do remember No level = No trade if you miss it due to gaps.

Thank you sir!