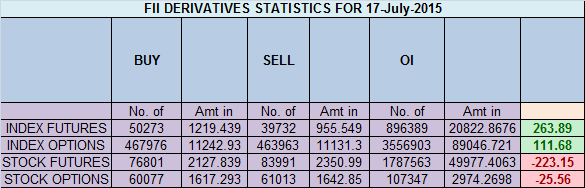

- FII’s bought 10.5 K contract of Index Future worth 263 cores ,3 K Long contract were added by FII’s and 7.5 K short contracts were squared off by FII’s. Net Open Interest decreased by 4.5 K contract, so today’s consolidation and dip in morning session was used by FII’s to enter longs in index futures Inspiring story of a handicapped lady trader who made 6 lakh in a single day

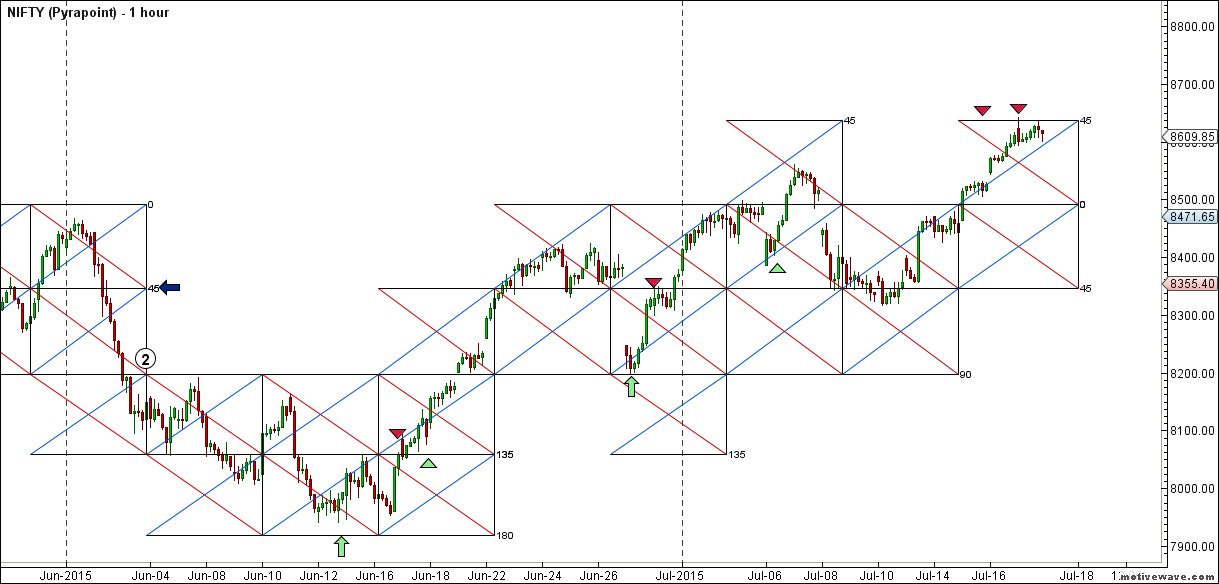

- As discussed in previous analysis Nifty closed above 1*2 gann line and today closed above supply demand, suggesting bulls are in control and heading towards 8645/8670 where pyrapoint resistance lies. Nifty in morning made high at exact pyrapoint resistance and was trading in small range through out the day. Trend is up as per daily bar technique and till we do not see lower lows do not short the market. Pyrapoint Analysis indicates big move round the corner.

- Nifty July Future Open Interest Volume is at 2.11 core with liquidation of 9.2 Lakh, with increase in CoC suggesting shorts by retails traders have entered the system. NF Rollover range @8357 has helped bulls.

- Total Future & Option trading volume was at 1.88 core with total contract traded at 2.6 lakh lowest in last 3 months. PCR @1.25, cool off from yesterday high of 1.33

- 8700 CE OI at 42.3 lakh , wall of resistance @ 8700 .8400/8700 CE added 0.7 lakh so bears got some respite added in minor quantity holding 7 lakhs overall. FII bought 23.1 K CE longs and 22.1 K CE were shorted by them.Retail bought 27.2 K CE contracts.

- 8500 PE OI@ 66 lakhs so strong base @ 8500. 8500/8700 PE added 25 lakh so on dull day also huge PE addition in 8500/8600 CE still holding 185 lakh suggesting bulls have made aggressive positions at lower levels . FII bought 52.2 K PE longs and 49.1 K PE were shorted by them.Retail bought 38K PE contracts.

- FII’s bought 605 cores in Equity and DII’s sold 175 cores in cash segment.INR closed at 63.47

- Nifty Futures Trend Deciding level is 8630 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8442 and BNF Trend Deciding Level 19180 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18636 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8636 Tgt 8662,8682 and 8708 (Nifty Spot Levels)

Sell below 8588 Tgt 8562,8542 and 8516 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

nice analysis do you mean we can se low of 8516 on nifty spot as mentioned by bramesh

Probability when Niftys Volume is low & Niftys price is rising in one direction can be that short side (short sellers) volume is less . Traders with long side volume is more & shortsellers are waiting for trend to get reversed for investing their funds in short side . so once trend reverses volume will spike with bulls & bears trys to take control the market. So trying to short sell of Nifty in low volume is a blind traders game Unless other wise trend reversal is confirmed.

nifty spot levels mean nifty cash or future of the current month? kindly clarify,

This is GST Rally. if bill passed new Nifty high round the corner .Otherwise next leg of correction. Strictly follow TCL.

Great. My conclusion, Top culmination by this week end in short term before a correction.

Sir….kindly correct date…Monday on 20th july

Hello Bramesh sir,

Just one question, can u throw some light on what happen when the volume is low in the market and the price is keep on rising.

No major impact till we see reversal.

Thank you bramesh ji. Just one comment. If fii bought total 10k index future contract, then 7.5k shorts should be bought by them to equal 10k