Last week we gave Chopad Levels of 8546 , Nifty opened with gap down and show a swift recovery from the lows and gave a long entry to Chopad followers which got stopped out and gave short entry on Tuesday and did 2 target on downside. Nifty made low of 8316 almost meeting 2 Chopad Level of 8323. Lets analyze how to trade market in coming week as we will get to know if Greek will get Bailout from its creditors before market opens on Monday. As of now Eurogroup Meeting Ends Without Agreement

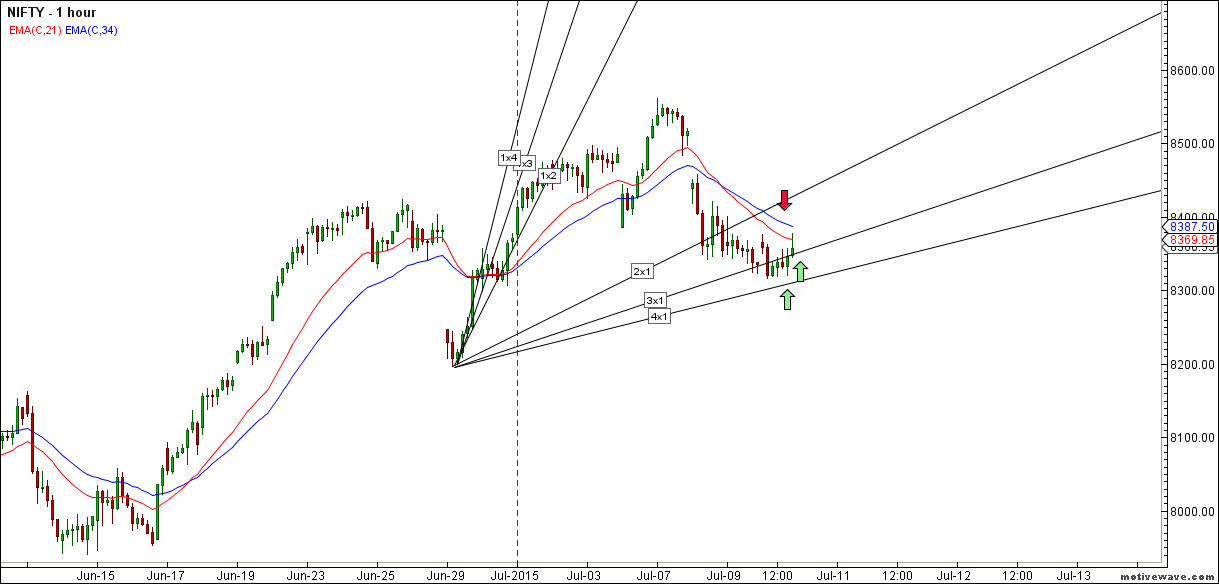

Nifty Hourly Chart

Breakout will come only on hourly close above 8412 as shown in above chart based on gann angle. Support in zone of 8313-8283.

Nifty Hourly Elliot Wave Chart

Hourly charts on Elliot wave shows we are heading towards 8600/8636 once 8413 is crossed and sustained.

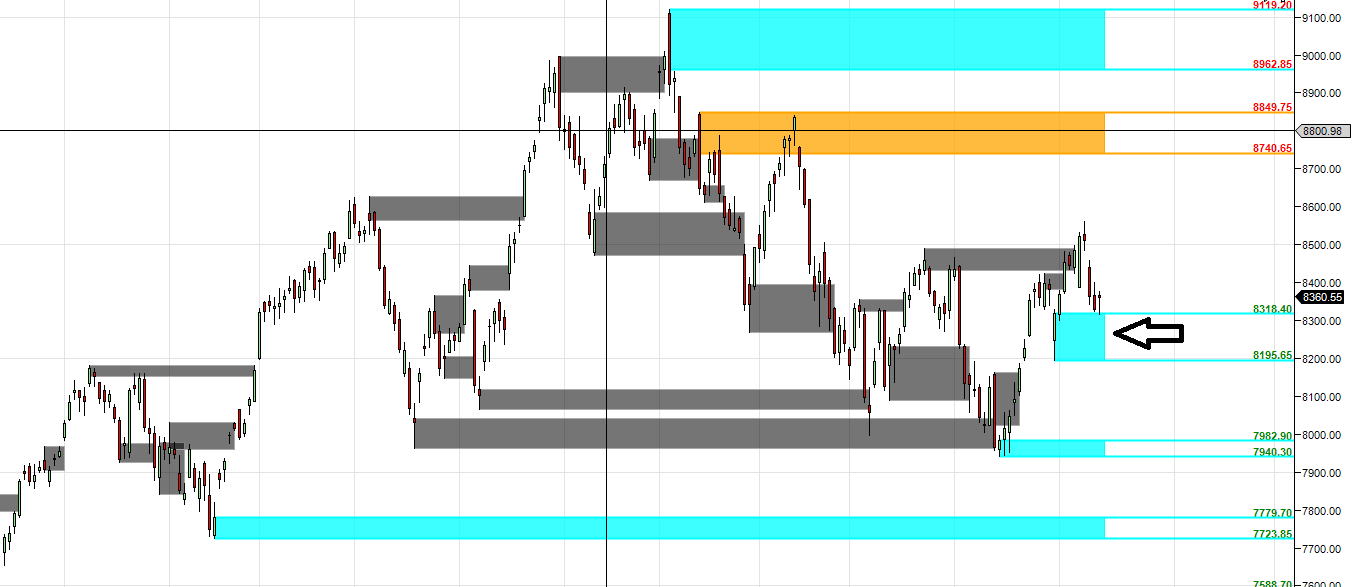

Nifty Pyrapoint Analysis

As per Pyrapoint Analysis till 8350 is held @45 degree line bulls are in control and can head above to 8636 odd levels, below that 8283 on cards.

Supply Demand Zone

Nifty has bounced from its demand zone as shown in above chart. Holding the same nifty can move towards its supply zone of 8670.

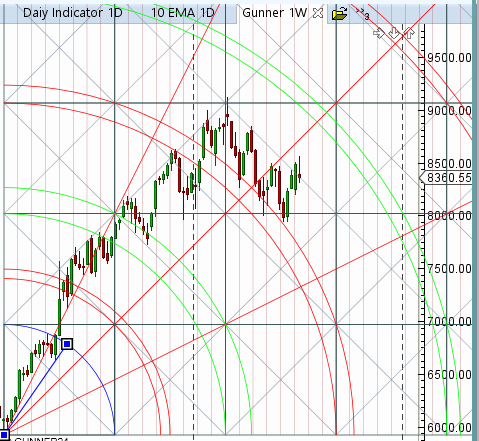

Nifty Gunner

Holding Gunner red arc price can move towards 2*1 gann angle.

Nifty Harmonic

Harmonic also suggests if range of 8412-8430 is held rally can continue till 8740/8800 in next 2 weeks. Else breaking below 8300 can see nifty moving towards 8195/8100

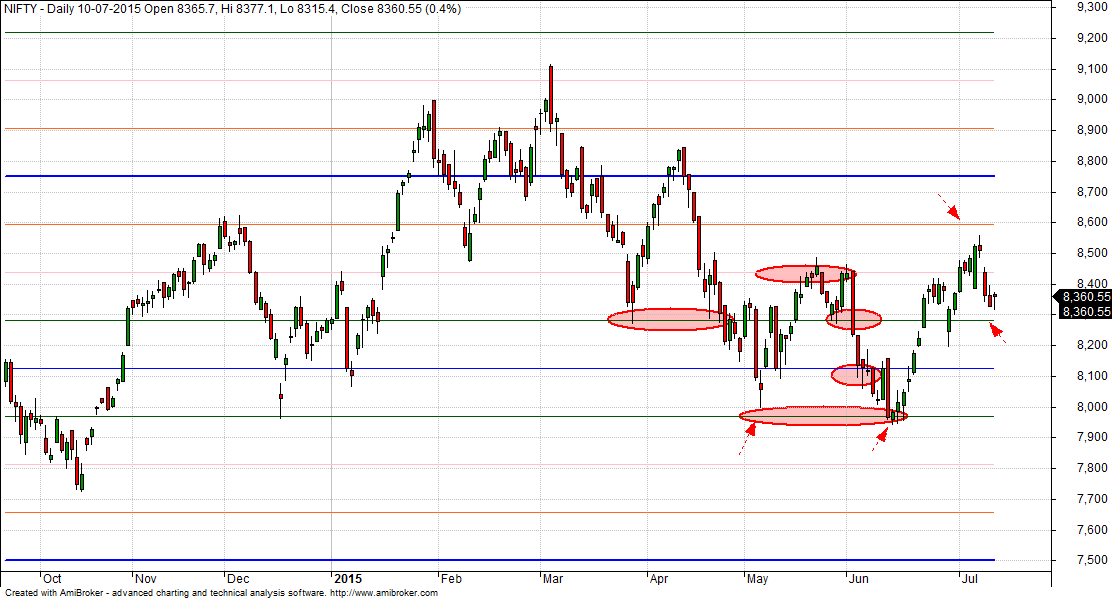

Nifty Daily Elliot Wave Chart

As per EW more legs are left to the rally use dips around 8000/7900 to take exposure to quality large and mid caps stocks. NO leveraged positions this for cash market traders.

Traders who bought must have bee rewarded.

Nifty MML

8276 is MML support zone and Resistance at 8440.

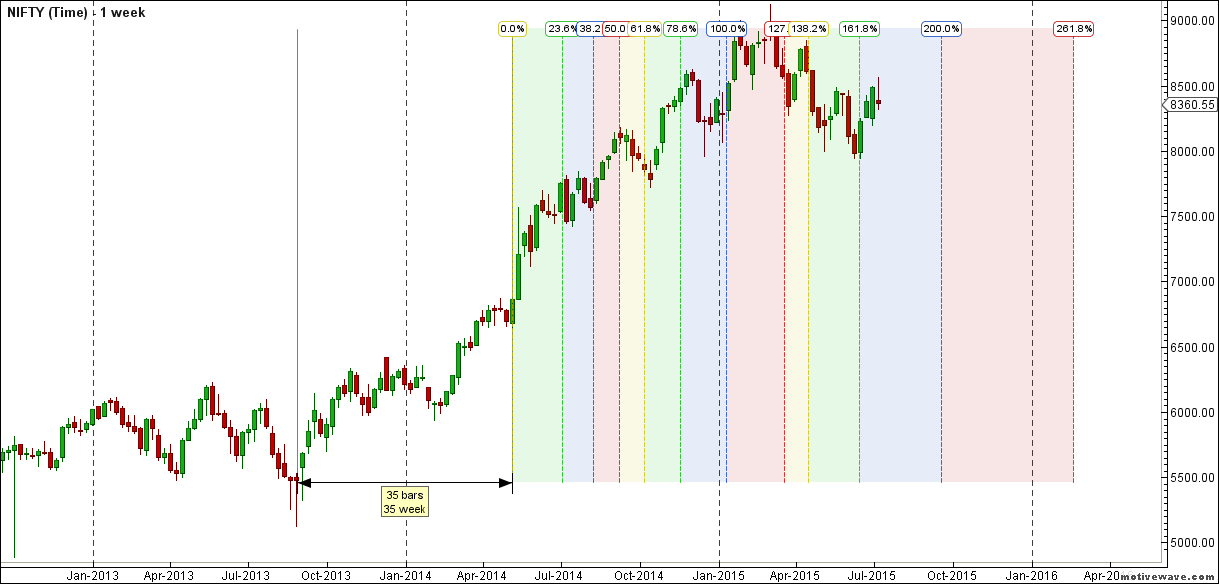

Nifty Gann Date

Nifty As per time analysis 14 July is Gann Turn date , except a impulsive around this dates. Last week we gave 08 July/10 July Nifty saw a volatile move .

Nifty Gaps

For Nifty traders who follow gap trading there are 15 trade gaps in the range of 7000-9000

- 7067-7014

- 7130-7121

- 7276-7293

- 7229-7239

- 7454-7459

- 7526-7532

- 7598-7568

- 7625-7654

- 7780-7856

- 7927-7940

- 8174-8195

- 8091-8102

- 8510-8457

- 8937-8891

Fibonacci technique

Fibonacci fan

Heading towards 61.8% retracement if 50% is held as per Fibo Fans.

8389/8499/8527 is fibo retracement as shown above are important level to be watched in coming week once crossed can head towards 8652/8665. Strong support in 8286.

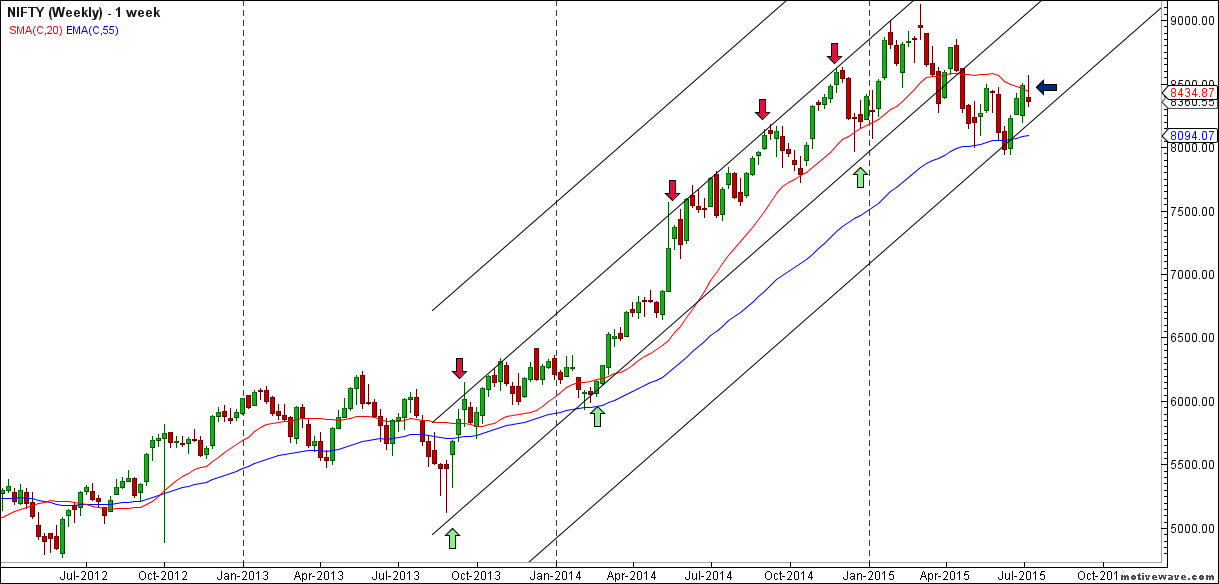

Nifty Weekly Chart

It was negative week, with the Nifty down by 124 points closing @8360 forming inverted hammer, and closing above its 55 WEMA and below its 20 WSMA. As per harmonic weekly bias nifty is ready for breakout on upside once 8561 is crossed and sustained. Time Analysis of showing positive move after 14 June worked perfectly

Weekly Gunner

Gunner weekly charts bounced perfectly from red arc and horizontal line and support @grey line as shown in above chart.

Trading Monthly charts

Monthly chart after 2 Month of hammer candlestick, bullish only above 8370.

Nifty PE

Nifty PE has broken on upside, and came down to take support at the triangle line. Lets see how result season move ahead .

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:8416

Nifty Resistance:8497,8560,8620

Nifty Support:8283,8196,8120

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please brief elaborately on Inverted Hammer and Hammer.

Sir I find your analysis very satisfactory, want to know how to trade using the chopad levels. Can you pls guide, I am a new comer in the market

Buy above/below Chopad level with a 20 points SL and Exit at Support/resistance

Rgds,

Bramesh

Hi Bramesh,

Could u pls tell how Gann turn date is calculated

Cheers

thank you this great article.

Bramesh ji , 1 question .

As per Time analysis , what Cycle is for Nifty in coming week?

is it Neutral to Bullish or Neutral to Bearish?

regards,

mohit

I have stopped giving weekly time cycle as mnay traders are getting confused.

Rgds,

Bramesh

okay sir . thanks!

in one of ur old post in comment section , you told The overall cycle till 25th september is Bullish .

so in this case every dip / fall is a buy?

sorry to ask too many questions .

regards,

mohit

This is what i have meant

Sirji pls tell us what abhay deep dubey asked there should be some correction

Thank you bramesh ji for the excellent analysis. One small correction. IN time analysis you have mentioned for the week 06-10 july. I guess this needs to be corrected.

There is divergence between Nifty and Bank nifty.Nifty in weak territory and Bank nifty in Strong Zone.Normally both index mimic each other and move in same direction.One of the index will change its course of direction very soon.Since Bank nifty is more manipulative index chances of it reversing its direction are higher.