- FII’s sold56.9 K contract of Index Future worth 1247 cores ,38 K Long contract were squared off by FII’s and 18.8 K short contracts were added by FII’s. Net Open Interest decreased by 19 K contract, so today’s fall was used by FII’s to enter shorts in index futures Thought process of Professional Traders

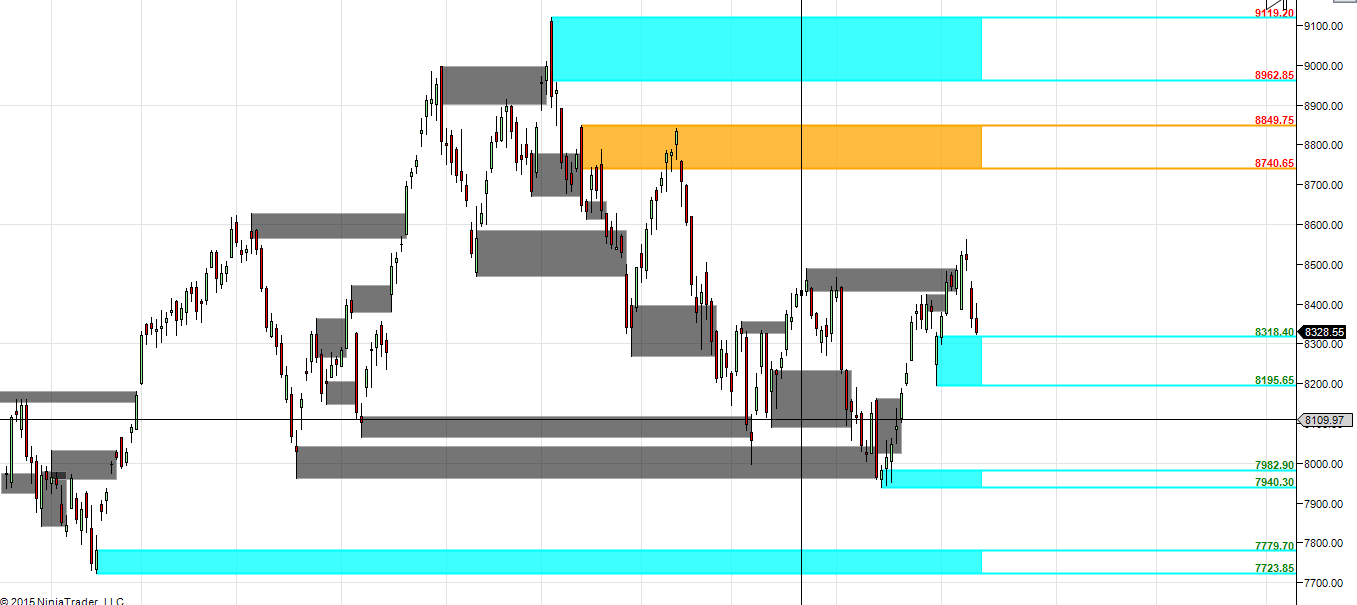

- Nifty tried to recover in morning trader but made a high of 8400 and made a lower low at 8323. 8318-8300 range is very important demand zone as shown in below chart, holding the same and moving above 8400 can see bulls coming back else we will see a further fall towards 8223 odd area. Weekly closing tomorrow bulls will want to close above 8400 bears below 8300.

- Nifty July Future Open Interest Volume is at 1.78 core with liquidation of 3.2 Lakh, with increase in CoC suggesting shorts have closed today. NF Rollover range @8357 should be kept close eye on,holding below bears are in control above it bulls have upper hand.

- Total Future & Option trading volume was at 1.76 core with total contract traded at 3.9 lakh. PCR @0.86.

- 8500 CE OI at 48.5 lakh , wall of resistance @ 8500 .8000/8500 CE added 15.9 lakh so bears added aggressively holding 49 lakhs overall. FII bought 35.1 K CE longs and 2 K CE were shorted by them.Retail bought 112 K CE contracts.

- 8000 PE OI@ 49.2 lakhs so strong base @ 8000. 8100/8500 PE liquidated 6.1 lakh still holding 87 lakh suggesting bulls have not lost hope . FII bought 26.1 K PE longs and 27.3 K PE were shorted by them.Retail sold 26 K PE contracts.So again retailers bought CE and market going down.

- FII’s sold 254 cores in Equity and DII’s bought 79 cores in cash segment.INR closed at 63.38

- Nifty Futures Trend Deciding level is 8365 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8407 and BNF Trend Deciding Level 18549 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18466 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8351 Tgt 8378,8400 and 8427 (Nifty Spot Levels)

Sell below 8320 Tgt 8300,8274 and 8225 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

bramesh i want to take a position which side i take call in nifty plz suggesting

levels are mentioned plz trade accordinlgy

Hi …. I think markets will bounce back

Yes, we are going to see big upside movement in nifty by next week. don’t panic at lower level

Hi bramesh on charts Nifty in weak territory.There is high probability of nifty spot hitting 8230 zone.Two key levels 8424 & 8460 levels will act as resistance.

Tomorrow nifty will be up by 2% and FII and DII will be buyer soon.

Mkts gona fall , results season is on , greece dosent effct india , its going towrds 8195 n thn 7899 . Its nt gona rise tomm as well . Bulls r tired .

Momentum is very strong and Market health is positive. Market in Up trend and forming higher high and higher low. In up trend when ever market fall to it’s demand zone then it take support and bounce back to make new high. I believe by next week market likely to rally till 8600. positive with greece and china so technically and fundamentally both way bullish.

If mkts start to move according to technicals then it would be called fairlyland n not stockmrkts .

Dear Mickey,

Market work on technicals but its traders who do not have discipline to follow levels and take loss and profit.

Its an emotional game which very few has control on.

Dear bramesh all i am saying is markets has a way of reacting , technicals and fundamentals are just a part .. emotion , rumour , misguidance and human error and manupulation also play a role . all i said was on a comment which said ‘2% upside tomm.’ — the comment clarifies the emotion , rumour n human error part .

Following fundaments and technicals only increases the chances of profit does not gurantee it .

Bramesh, it seems a confused market and clearing as there is no real open porition in the last 8 days in futures by any major players namely client or FII.Events like Greece and corporate results will influence the markets.