- FII’s sold 9.1 K contract of Index Future worth 119 cores ,43.4 K Long contract were added by FII’s and 52.6 K short contracts were added by FII’s. Net Open Interest increased by 96 K contract, so today’s fall was used by FII’s to enter shorts and longs in index futures, as we are nearing Expiry and rollovers are happening so we are getting both long and shorts addition for FII’s .Focus On Trading Signals & Kill Noise while trading

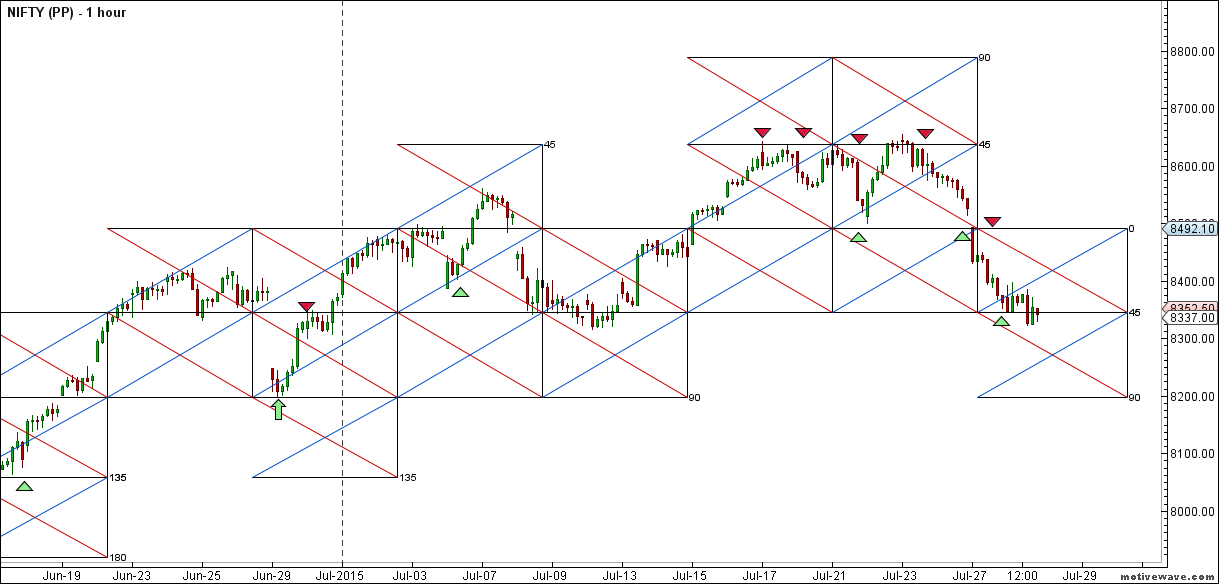

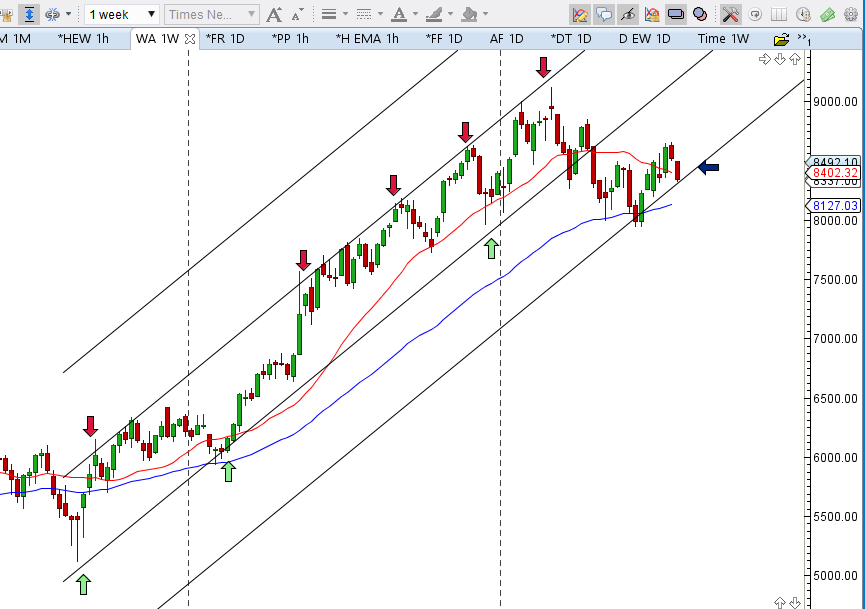

- Nifty continued forming lower lows and closed below 8350 just below 50 SMA, So in 2 trading session nifty has closed below its all short and long term moving averages. . Bullish only on close above 8398, Break of 8300 can see quick move towards 8200/8150 in extreme short term.Nifty is also near its weekly trendline support, next 3 days price action is important to see if nifty breaks below it or bounces back as it did last 2 times.

- Nifty July Future Open Interest Volume is at 1.48 core with liquidation of 30 Lakh, with increase in CoC suggesting short positions got closed today.38% rollover has taken place in NF with rollover price coming @8538

- Total Future & Option trading volume was at 4 core with total contract traded at 5.3 lakh. PCR @0.86

- 8500 CE OI at 59.3 lakh , wall of resistance @ 8500 .8300/8500 CE added huge 22 lakh so bears continue to add bulls are running for cover. FII bought 1.4 K CE longs and 0.03 K CE were shorted by them.Retail bought 110 K CE contracts.Retailers buying CE and market going down.

- 8300 PE OI@ 46.4 lakhs base @ 8300 getting jittery. 8400/8700 PE liquidated 9.1 lakh so major liquidation seen in 8500/8600 PE and buying was seen in 8400 PE . FII bought 28.3 K PE longs and 14.9 K PE were shorted by them.Retail sold 86 K PE contracts.

- FII’s sold 1375 cores in Equity and DII’s bought 666 cores in cash segment.INR closed at 63.91

- Nifty Futures Trend Deciding level is 8372 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8470 and BNF Trend Deciding Level 18315 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18671 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8353 Tgt 8380,8400 and 8427 (Nifty Spot Levels)

Sell below 8305 Tgt 8278,8250 and 8231 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Great OI analysis. Elliott Wave analysis is suggesting a touch below 7940 in near term, may be in August Series. Any corrective bounce of 23% to 38% may be used for Sell on Rise with tight stop loss.

Bramesh, how did you arrive this rollover price @8538?

am to in confusion I think its typing error

“The teacher who is indeed wise does not bid you to enter the house of his wisdom but rather leads you to the threshold of your mind.”

-Khalil Gibran

Dear all.. I was Short @ 8380+8530+8630= 8513 (75 qty ) average…Bought back at 8380 today = 9975 profit.. Play one side… either short or Long… Must have holding capacity thats it.. Acount Balance =100000/- profit 9975 rate of return nearly 10% per month … what else we need..

Hi shivkumar congrats may I plz know how much margin is required to short one lot NF and who is your brokerage

17000 Margin required to take position in Nifty Futures …I trade with Nirbang Securities

nirmal bang okay some what costlier

Sab FIIs and DIIs ka khel hai Bazaar ……Jitna aap ke Paisa hai utne mein one side khelo …Long ya phir short…

for day trading nifty futures using gann square of 9 should we use LTP or weighted average price of nifty futures. Sir plz reply

Excellent as always

NF with rollover price coming @8538, sir its 8358?

8538 for August Series

thank you sir

Nifty completed its double top pattern tgt today on daily bar.Three black crows candlestick pattern is major bearish pattern and if follow through selling happens below 8300 nifty will first test 61.8% retracement of entire move from 7940 to 8655 at 8213 and after that selling overhang can remain till September series for ultimate tgt of 7700.key for uptrend to resume GST passage and MAT tussle solved in favours of FIIs.

Sir what is the nifty level of weekly trendline support

8300