Last week we gave the Chopad level of 18816 Bank Nifty opened with gap down and show a swift recovery from the lows and gave a long entry to Chopad followers which got stopped out and gave short entry on Tuesday and did 2 target on downside. Lets analyze how to trade market in coming week as we will get to know if Greek will get Bailout from its creditors before market opens on Monday. As of now Eurogroup Meeting Ends Without Agreement. We also have CPI inflation data coming in Evening 5:30 PM and WPI on Tuesday 12:30 PM

Bank Nifty Hourly

Bank Nifty need to cross the zone of resistance @18767-800 for a breakout to happen. Unable to cross the same can see down move till 18600 odd levels as shown in above chart.

Bank Nifty Hourly EW

Hourly Elliot wave analysis is shown, 18760 will play crucial levels next week.

Bank Nifty Pyrapoint Indicator

Bank NIfty has been trading in the range of 135 and 90 degree pyrapoint angle, 90 degree has proved to be an elusive resistance from past 2 months.135 degree as strong support, one of this level will break in coming 2 weeks to give a trending move.

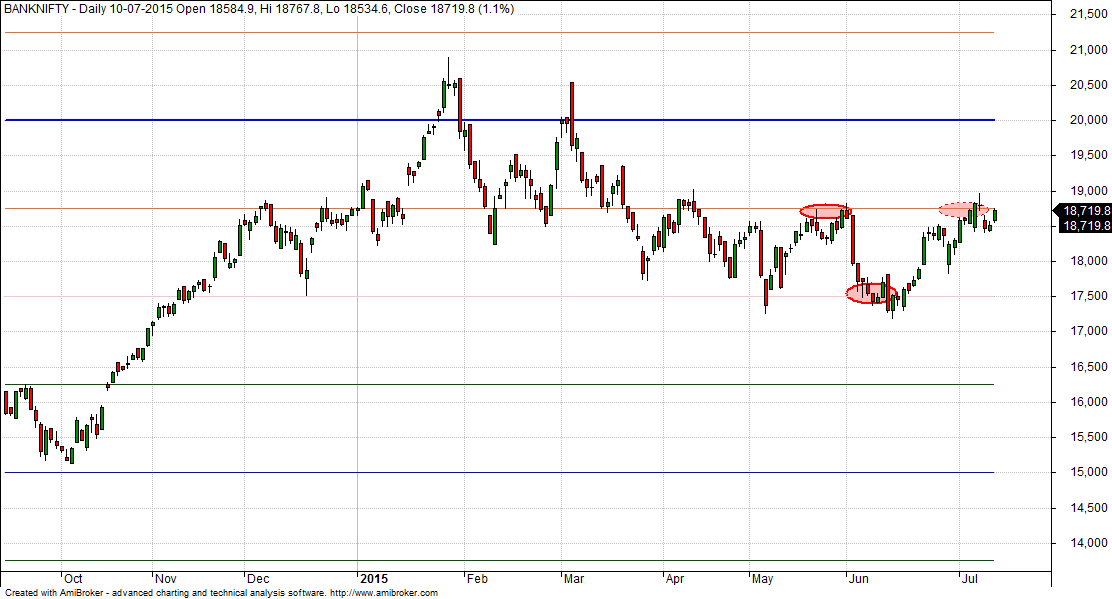

Supply Demand Zone

Demand and supply zones are shown above,Entered the supply zone, will it be able to cross ?

Bank Nifty Murry Math Line

Bank Nifty is heading towards crucial bank nifty MML pivot of 18756 which again has acted strong resistance for quiet some time as shown in above chart, closing above it and break of 18832 will be a big booster to bulls, unable to do so bears will have upperhand.

Bank Nifty EW Daily

Use dips to keep accumulation quality banking stocks. Long term targets are still pending as shown above.

Who bought banking stocks should have been rewarded handsomely, profit booking is always advised.

Bank Nifty Daily Gunner

Crossed 1×2 gann line heading towards horizontal line quadrant.

Bank Nifty Gann Dates

Bank Nifty as per time analysis 14 July is Gann Turn date , except a impulsive around this dates. Last week we gave 08 July/10 July Nifty saw a volatile move .

Fibonacci technique

Fibonacci Fans

Again held on to its 50 % and heading towards 61.8 % if 18756 is broken or 18200 is not broken as per FF

Bank Nifty Weekly

It was negative week, with the Bank Nifty down by 9 points closing @18719 , price again held its 55 WSMA able to cross 20WSMA and median of AF line. Holding the same it can move to 19200/19500 zone. Time Analysis of showing positive move after 14 June worked perfectly

Bank Nifty Weekly Gunner

Weekly gunner 18832 needs to be crossed if not will see pullback towards horizontal line

Bank Nifty Monthly

Monthly chart after 2 Month of hammer candlestick, has started the July month of bullish note till 18260 not broken bias is bullish.

Bank Nifty Weekly Chopad Levels

Bank Nifty Trend Deciding Level:18720

Bank Nifty Resistance:19000,19250,19500

Bank Nifty Support:18600,18426,18166

Levels mentioned are Bank Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Thanks Bramesh, for your hard work

Thank you sir