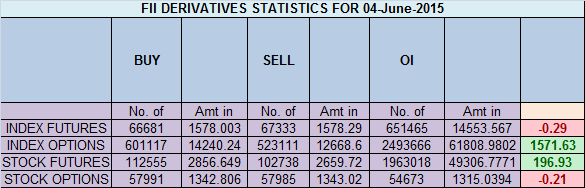

- FII’s sold 652 contract of Index Future worth 0.29 cores ,22.2 K Long contract were added by FII’s and 22.8 K short contracts were added by FII’s. Net Open Interest decreased by 652K contract. Types of Confidence in Trading Why Adani Enterprises Shares Crashed ?

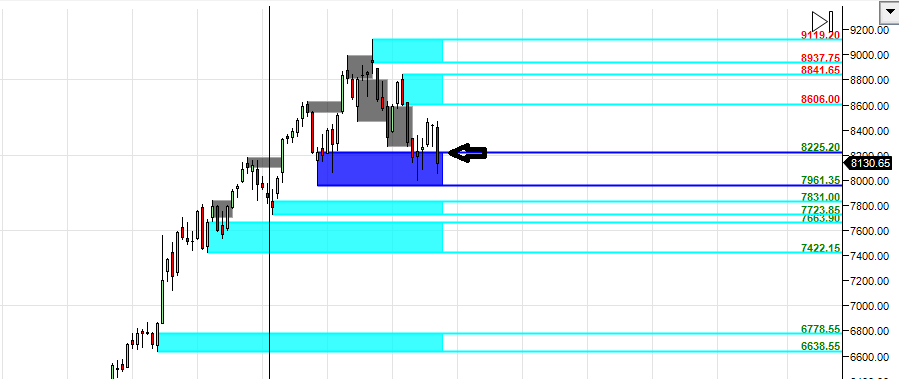

- Nifty again held on the gann line as per gunner chart with recovery coming in last hour. I have shared the demand and supply Weekly chart as we have weekly closing tomorrow Bulls need to close above 8200/8225 range which is also 50 WSMA. Bulls have defended the from past 4 weeks will they be able to do for 5 time ?

- Nifty June Future Open Interest Volume is at 1.62 core with addition of 2.3 Lakh, with increase in CoC suggesting shorts have been closed .

- Total Future & Option trading volume was at 1.91 core with total contract traded at 4.7 lakh. PCR @0.86.

- 8500 CE OI at 48.6 lakh , wall of resistance @ 8500 .8100/8400 CE added 35 lakh ,so aggressive addition by bears and holding 56 lakh in open position. FII sold 1K CE longs and 4 K shorted CE were covered by them.Retail traders bought 0.60 lakh CE contracts.

- 8000 PE OI@ 45.3 lakhs so strong base @ 8000. 8100/8500 PE liquidated 11 lakh so bulls finally got the heat , Holding 22 lakh open position. FII bought 83.8 K PE longs and 9.8 K PE were shorted by them.

- FII’s bought 511 cores in Equity and DII’s bought 772 cores in cash segment.INR closed at 64.

- Nifty Futures Trend Deciding level is 8118 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8295 and BNF Trend Deciding Level 17680 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18272 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8156 Tgt 8174,8200 and 8220 (Nifty Spot Levels)

Sell below 8110 Tgt 8074,8050 and 7997(Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Which software is used for drawing this ”demand /supply” chart?

Ninjatrade

correction : DII bought in Cash 772.04

i think some wrong calculation in call and put (fii analysis)..kindly once chek again ..

(FII bought 36.4 K CE longs and 17.6 K CE were shorted by them.Retail traders bought 1.2 lakh CE contracts.FII bought 90 K PE longs and 8 K shorted PE were covered by them.)

Thanks its corrected.

it seems nifty might make inverted head and shoulders pattern. 4th June fall and recovery was the formation of head section of the pattern. It might stay near 8150 for couple of days and then move up.

So very perfect. Todays high 8091 and then whammm.

Couple of positive points, Perhaps

1. It did not test yesterdays low, although its the lowest closing since May7

2. Technically Nifty looking extremely oversold, so think a bounce back should be on cards.

Please share your views.

Thanks,

hi sir kindly give me your phone no ,i want to talk to you in regards to training.

09985711341