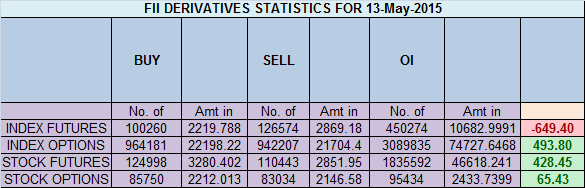

- FII’s sold 26.3 K contract of Index Future worth 649 cores,2 K Long contract were added off by FII’s and 28.3 K short contracts were added by FII’s. Net Open Interest increased by30.4 K contract so today’s rise was used by FII’s to add shorts in Index Future. Can money be made in trading ?

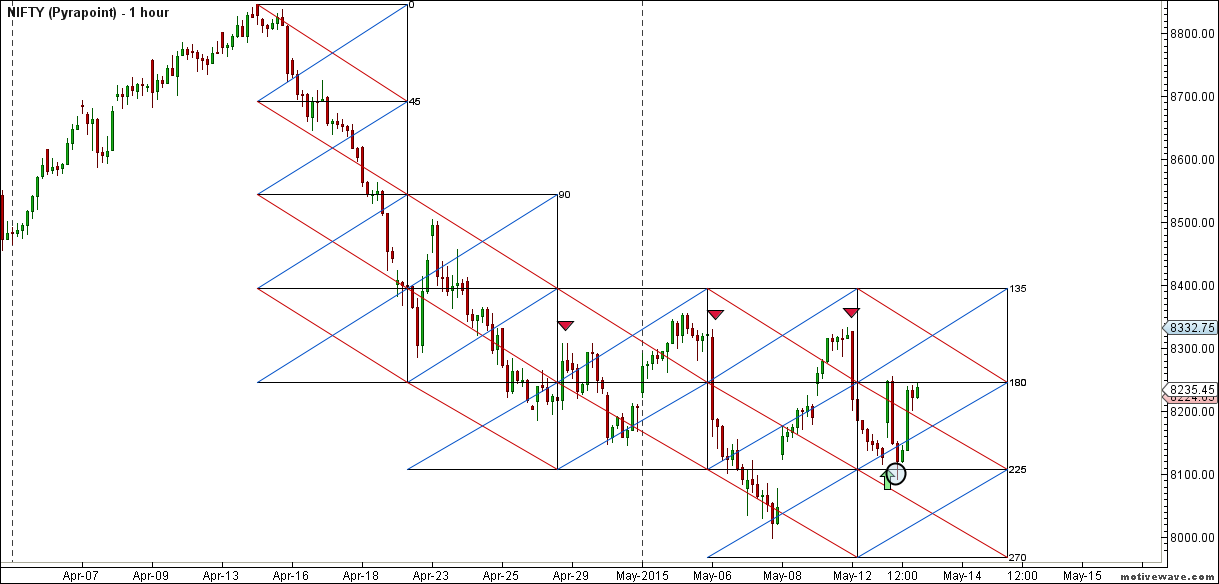

- This is what we discussed yesterday analysis 225 degree pyrapoint line @8103 if broken can see move towards 8052/8007.Nifty made low of 8089 and bounced back sharply.Gann Line as shown in below gunner chart @8332 is the laxman rekha from bulls and bears , close above it bulls rule and close below it bears will make marry. Such volatility we are seeing is generally formed near short term bottom and a trending move will be soon seen. As per pyrapoint analysis move 8255 short term target 8332/8395. Unable to do so nifty can revisit the lows formed today.

- Nifty May Future Open Interest Volume is at 1.38 core with reduction of 2.2 lakhs with cost of carry going positive suggesting short position got closed. OI is lowest in last 3 months, such low OI generally suggests trending move is round the corner.

- Total Future & Option trading volume was at 3.18 core with total contract traded at 8.9 lakh. PCR @0.93.

- 8500 CE OI at 45.5 lakh , wall of resistance @ 8500 .8100/8400 CE saw liquidation of 10 lakhs ,so weak bears got panicked ,still bears are holding 90 lakh open position. FII bought 33 K CE longs and 24.3 K CE were shorted by them.Retailers have sold 0.97 lakh CE contracts in today’s session.

- 8000 PE OI@ 47.1 lakhs so strong base @ 8000. 8100/8400 PE liquidated 2.2 lakh so bulls ran for cover and holding just 18 lakh open position. FII bought 18.5 K PE longs and 5.3 K PE were shorted by them. Retailers have bought 52.8 K PE contracts in today’s session.

- FII’s sold 71 cores in Equity and DII’s bought 254 cores in cash segment.INR closed at 64

- Nifty Futures Trend Deciding level is 8206 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8233 and BNF Trend Deciding Level 17922 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18089 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8255 Tgt 8290,8332 and 8358 (Nifty Spot Levels)

Sell below 8190 Tgt 8160,8130 and 8100 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hi Ramesh, just wanted to check how to segregate the calls or put in the open interest. i.e if nifty open interest is 40000 how to identify that how much is call and how much is put.

Nifty May Future Open Interest Volume is at 1.38 core with reduction of 2.2 lakhs and not addition as you have mentioned .

Good stuff, The India Vix appears to be making a rounding bottom type pattern on the daily chart that targets close to 35, so my belief is that after a brief bounce, we may make newer lows later this year. Also Rupee weakness is a major concern.