- FII’s sold 5.5 K contract of Index Future worth 165 cores,3.6 K Long contract were squared off by FII’s and 1.9 K short contracts were added by FII’s. Net Open Interest decreased by 1.7 K contract.How to move from Unsuccessful trader to Profitable trader

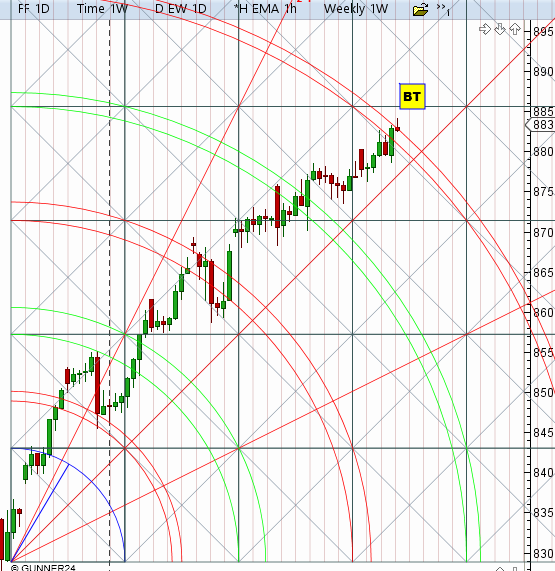

- Nifty continued with its rally forming higher high and higher low pattern. Till 8762 is not broken trend remains up, As per Gunner charts on both Hourly and daily Nifty is heading towards the resistance zone of 8850-8863 range which are target as per gunner pattern , so longs can book out in this range. Nifty EW charts are also shown below, the pink region which also lies in range of 8850-8863 will act as strong supply zone so caution advised on longs.

- Nifty April Future Open Interest Volume is at 1.87 core with liquidation of 3.4 lakhs with increase in cost of carry suggesting short position got closed.

- Total Future & Option trading volume was at 1.84 core with total contract traded at 3.4 lakh. PCR @1.17 suggesting sentiments is turned excessive bullish.

- 9000 CE OI at 52.3 lakh , wall of resistance @ 9000 .8800 CE saw liquidation of 5.3 lakhs ,so bears who added on thursady liqudated all in Fridays session. FII bought 30.3 K CE longs and 30.1 K CE were shorted by them.

- 8500 PE OI@ 47.5 lakhs so strong base @ 8500. 8600/8800 PE added 27.3 lakh so bulls so total 55 lakh were added in 4 days and are making position for higher levels. FII bought 4.7 K PE longs and 12.1 K PE were shorted by them.

- FII’s bought 417 cores in Equity and DII bought 46.4 cores in cash segment.INR closed at 62.52.

- Nifty Futures Trend Deciding level is 8836 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8642 and BNF Trend Deciding Level 18877 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18546 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8841 Tgt 8863,8892 and 8942 (Nifty Spot Levels)

Sell below 8810 Tgt 8783,8762 and 8733 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Brilliant. GANN date April 13 / 15 as per your previous post – Nifty weekly analysis

Like it n love it.

Bramesh sir,

thanks for caution. Rel. infra seems to have bottomed out and in upward trend for longer term perspective. Will remain obliged for your valuable contribution.

Chanchal Chakraborty

Yes ur analysis is correct. Trade with SL

Rgds,

Bramesh