- FII’s bought 5.5 K contract of Index Future worth 170 cores,8.1K Long contract were added by FII’s and 2.5 K short contracts were added by FII’s. Net Open Interest increased by 10.7 K contract.So again we got a volatile day which was used by FII’s to buyer at lower level.

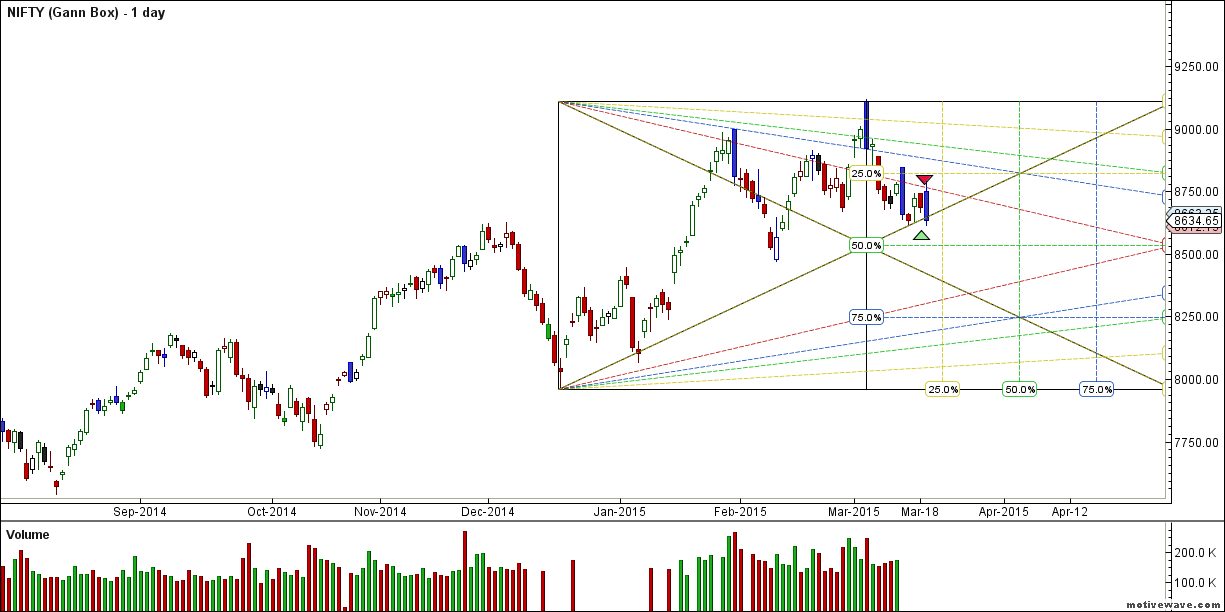

- As discussed in Weekly Analysis we are in volatile cycle and it will be there till 27 March and same is experienced today also. As per Pyrapoint Analysis Nifty Opened above 135 degree line took resistance at red line as shown in below chart and once the blue line got broken saw fast and swift decline and is heading near the zone of support marked via green arrow. Gann Box also suggests we are entering a support zone and shorts should be cautious. We have seen fast volatile move in range of 8600-8800 in past 9 trading session, suggesting trending move is round the corner. Market is consolidating in a range to prepare a base for next round of move.

- Nifty March Future Open Interest Volume is at 2.31 core with liquidation of 2.8 lakhs with decrease in cost of carry.

- Total Future & Option trading volume was at 3.85 core with total contract traded at 6.8 ,lakh. PCR @0.96.

- 9000 CE OI at 59.1 lakh ,wall of resistance @ 9000 .8600/8900 CE saw addition of 19.3 lakhs,so bears added big time in 8800 CE and still holding 100 lakhs in past 5 session. FII bought 39.9 K CE longs and 3.8 K shorted CE were covered by them. Biggest beneficiaries of this range bound move in the series is for Option Writers.

- 8500 PE OI@ 49.8 lakhs so strong base @ 8500. 8700/8900 PE saw addition of 0.45 lakhs so bulls started adding to their position,and no panic in bull camp is seen and still no major liquidation . FII added 7.7 K PE longs and 7.2 K PE were shorted by them.

- FII’s bought 1428 cores in Equity and DII bought 53 cores in cash segment.INR closed at 62.51.

- Nifty Futures Trend Deciding level is 8730 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8829 and BNF Trend Deciding Level 19173 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 19367.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8657 Tgt 8680,8701 and 8743 (Nifty Spot Levels)

Sell below 8614 Tgt 8590,8570 and 8550 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Expiry 8779

Sir any other analysis you have for bull market

Fii datta showing that a bounc back to come today or monday

bramesh ji , plz get the right click enabled

regards

kamaldeep

Ya. Cant view the Nifty Charts at all.

Inspite of huge buying by fiis n diis why have markets fallen almost 500points from high.

ANY GUESS FOR EXPIRY FIGURES FOR NF AND BNF