- FII’s sold 30.2 K contract of Index Future worth 870 cores, 150 K Long contract were squared off by FII’s and 138 K short contracts were squared off by FII’s. Net Open Interest decreased by 289 K contract,79.3 % Rollover is done in Nifty Future at an average rate of 8837. I have discussed which traders can use as an Input to their trading plan for Budget Day Stock Market Response to past Union Budget and Option Trading Strategy for Union Budget 2015 .

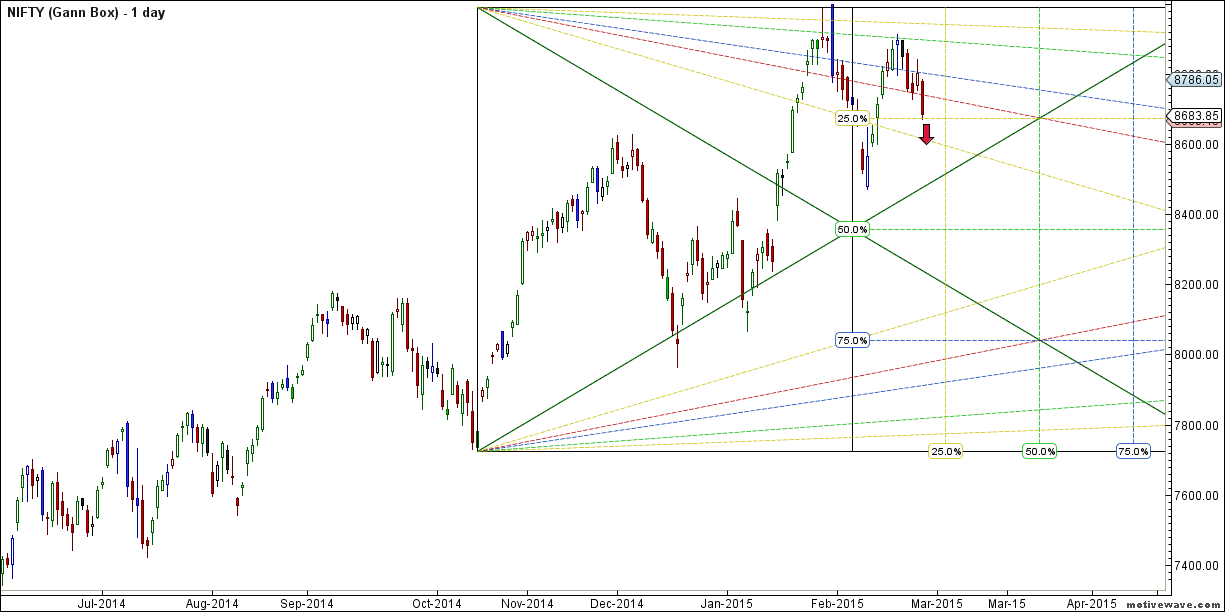

- We saw the best Railway Budget presented today in past 10 years which was practical and pragmatic. Nifty reacted on railway budget day with negative as it happened on last railway budget and forewarned in yesterdays analysis Last time on Railway Budget on 8 July Nifty was down 213 point on Railway Budget day so trade very cautiously. Also Nifty was trading below 21/34 HEMA and unable to cross the gann box line suggesting weakness. On Hourly chart we are near trendline support break of 8640 can see further fall towards 8600-8580 range. Holding the same bounceback can be seen till 8750 levels.

- Nifty March Future Open Interest Volume is at 2.39 core with addition of 42.1 lakhs.

- Total Future & Option trading volume was at 5.81 core with total contract traded at 6 lakh. PCR @0.79.

- 9000 CE OI at 38.2 lakh so wall of resistance @ 9000 .8700/8900 CE added 10 lakhs, major change in OI will be seen after budget event.

- 8500 PE OI@ 32.8 lakhs so strong base @ 8700. 8600/8800 PE saw addition of 11 lakhs so bulls have started adding but no major indication as of now. Range stands at 8500-9000

- FII’s bought 2312 cores (Bharti Infratel deal of Rs 1925 cores + LNT FH deal of Rs 245 core total 2170 crores) in Equity and DII bought 340 cores in cash segment.INR closed at 61.74.

- Nifty Futures Trend Deciding level is 8761 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8761 and BNF Trend Deciding Level 18770 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18770 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8714 Tgt 8756,8786 and 8829 (Nifty Spot Levels)

Sell below 8669 Tgt 8640,8596 and 8550 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Bramesh,

The option premiums are very high as of now tot take up straddle positions , please suggest on what to do during such situations . As most of the traders expect market to move in specific direction during or post budget day, buying CALLS and PUTS equally will just erode the money instead of giving opportunity , your idea please on this

When we do not have opportunity avoid trading. If capital is protected we can live another day and take trade as and when opportunity arises.

Rgds,

Bramesh

Thanks a lot Bramesh for providing FIIs and DIIs figures regularly on your blog. It helps to expect the continuation or reversal of trend. As the Elliott Wave Counts are concerned, it seems a sharp bounce followed by a decline is still pending. Let’s see what is there for Nifty on budget.

Thanks for your EW Analysis..

@ Bramesh..There are no details of how many FII bought or sold calls and puts..In today’s data, this is missing..thanks

As its Expiry day so no point in analyzing FII Option Figures.

Thanks Bramesh Ji ….your analysis are very good for everyone… Request you to shed some light on ‘roll over’ of nifty and what does it mean when you say nifty future got rolled over at a rate of xxxx… I am new and dont have any idea about this.

Thanks Will try to write an article over it.