- FII’s bought 3.5 K contract of Index Future worth 164 cores, 45 K Long contract were added and 41.5 K short contracts were added by FII’s. Net Open Interest increased by 86.5 K contract , so FII added longs in Index futures also shorts were added almost in 1:1 ratio.

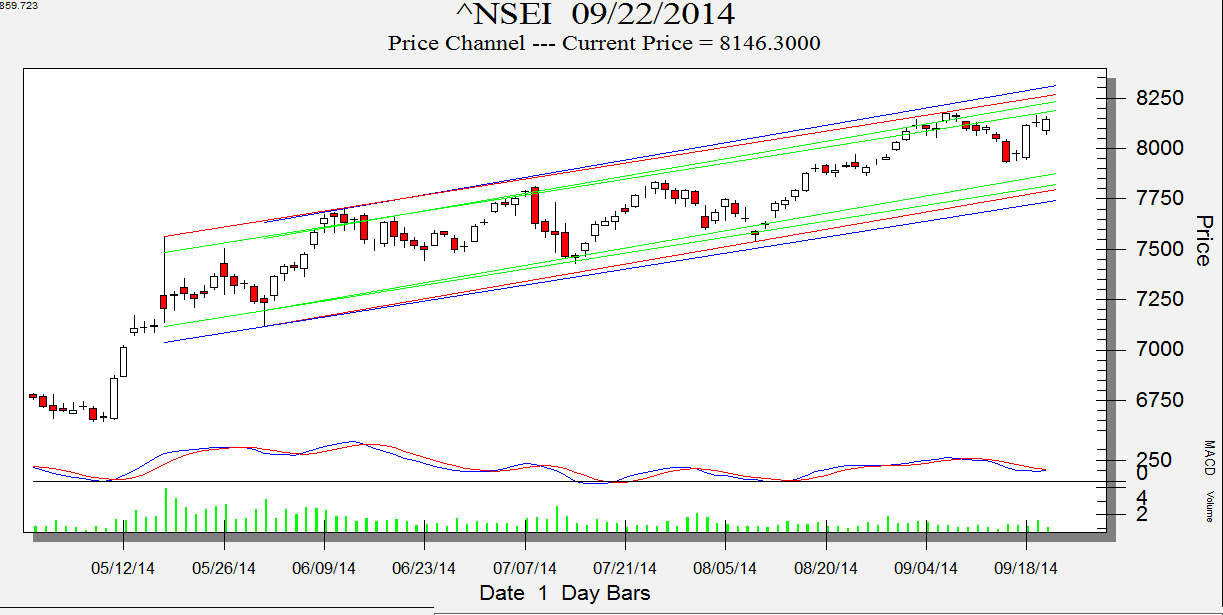

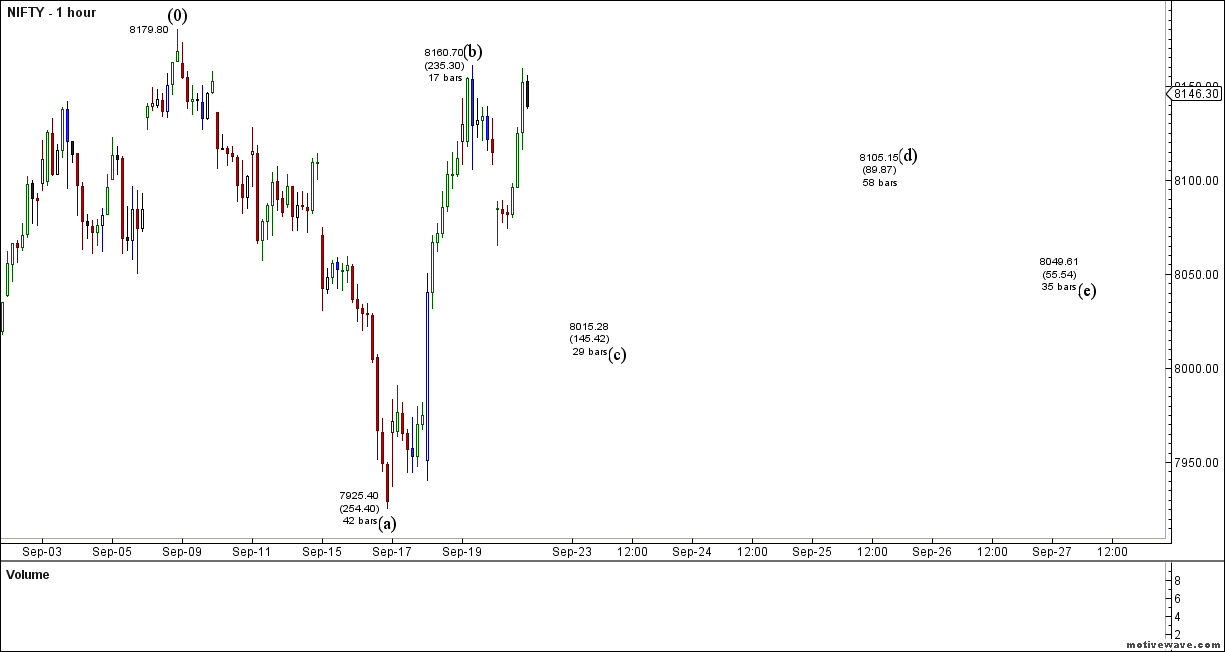

- Bounce seen today was because of Rollover pressure, Nifty again got resisted near the Price Channel as shown in below chart also formed a double top in daily chart, which need confirmation in next 2 days with price not going above 8160 and breaking 8064.Break below 8064 can see a quick down move towards 8015. Gann Turn date today so be cautious in trading expect volatile moves today.

- Nifty Future Sep Open Interest Volume is at 1.10 cores with liquidation of 16.5 lakh which completely got rollovered to October series.

- Total Future & Option trading volume was at 3 lakh core with total contract traded at 2 lakh. PCR @1.01.

- 8200 CE OI at 76.8 lakh suggesting wall of resistance , 8100 CE liquidated 2.5 lakh suggesting bears have started booking profit.8000 CE also liquidated 3.2 lakh so 8000 is base for expiry. FII’s bought 12.2 K CE longs and 19.4 K CE were shorted by them.

- 8000 PE OI@ 82.3 lakhs so strong base @ 8000. 8100 PE OI@60 so support building up @8100 not so strong as of now, So fight for 8100 will be seen in coming 2 days . FII’s bought 4.6 K contract PE longs and 1.5K PE contract were shorted by them.

- FII’s sold 186 cores in Equity and DII bought 31 cores in cash segment.INR closed at 60.86.

- Nifty Futures Trend Deciding level is 8116.23 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8095 and BNF Trend Changer Level (Positional Traders) 16120.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8125 Tgt 8160,8180 and 8200 (Nifty Spot Levels)

Sell below 8110 Tgt 8087, 8060 and 8040 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir, how did you calculate long and short postitions of FII’s “FII’s bought 3.5 K contract of Index Future worth 164 cores, 45 K Long contract were added and 41.5 K short contracts were added by FII’s.”

Hi,

Bramesh sir, will you please give a example of how to trade in nifty options on intra day basis.

How to plot charts for intraday nifty ? 5min. 1min. ??

What indicators to use for intra day trading. Currently i am using Bollinger bands , MACD and Full Stochastic. These three give good results on daily charts. But how to use them on intraday basis?

For intraday other than NIFTY which shares can be used to trade? How to identify the correct share to trade in.

Regards,

Dhananjay

Dear Sir,

I cover the same in my trading course.

Rgds,

Bramesh