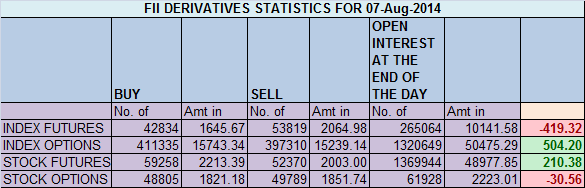

- FII’s sold 10985 contract of Index Future worth 419 cores, 15.6 K Long contract were squared off and 4.6 K short contracts were squared off by FII’s. Net Open Interest decreased by 20.2 K contract.FII’s exited both long and shorts today with Nifty giving volatile move.

- Nifty closed below its 20 DMA, Yo YO swing between Bulls and bears Continue today also with nifty swinging wildly between 7630-7709. We also have a freak trade today when NIfty Future jumped from 7709 to 7748 in matter of 4 minutes between 1:54-1:58. If data is observed 338 contracts of NF got traded at 7709 and than 9828 contract got traded at 7748. Nifty has been frustrating the traders from past 4 trading sessions as going up and down alternate day, triggering SL of Trend followers. Traders need to understand, market cannot move in straight line and will trade in a range like currently 7630-7752 and than give the anticipated big move which is very near. As per EW we can start the iii wave on hourly chart with break of 7595 which can take all the way to 7503. We have weekly closing tomorrow Bulls wants a close above 20 DMA and bears below 50 DMA. SBI results tomorrow and they will set the trend of market for tomorrow.

- Nifty Future Aug Open Interest Volume is at 1.30 cores with liquidation of 6 lakh suggesting long liquidation with increase in CoC. VIX being very low suggests bulls are getting overconfident.

- Total Future & Option trading volume was at 2.05 lakh core with total contract traded at 2 lakh. PCR @0.82,PCR has decreased from 1.01 to 0.82. This indicates higher activity on the Call segment – more calls being written at the various strikes.

- 8000 CE OI at 55.9 lakh suggesting wall of resistance , 7800 CE saw addition of 1.4 lakh with 22 lakh in past 3 days suggesting bears are getting stronger @ 7800.FII’s bought 16.7 K CE longs and 19.6 K CE were shorted by them. Huge short in CE needs to be taken by caution.

- 7300 PE OI@ 53.7 lakhs saw liquidation of 5.7 lakh suggest bulls are getting jittery near 7300 , 7500 PE has negligible addition in OI, and 7600 PE also liquidated negligible OI , these 2 strike prices needs to be seen tomorrow any sign of unwinding will suggest we will break 50 DMA tomorrow.FII’s sold 34 contract PE longs and 16.9 K shorted PE were covered by them.Again FII are covering shorted PE and shorting CE suggests net to net basis going short in Nifty in Option segment also.

- FIIs sold 73 cores in Equity and DII bought 228 cores in cash segment.INR closed at 61.23.

- Nifty Futures Trend Deciding level is 7693 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7714 and BNF Trend Changer Level (Positional Traders) 15280 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7663 Tgt 7695,7740 and 7772 (Nifty Spot Levels)

Sell below 7630 Tgt 7610, 7584 and 7538 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates