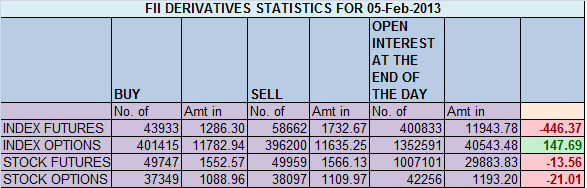

- FIIs sold 14729 contracts of Index Future worth 446(711 Long contracts were squared off and 14018 short contract were added) with net Open Interest increasing by 13307 contracts, so FII’s squared off longs and huge shorts were added by them.

- Nifty was able to protect its 200 DMA, for second day running.Nifty has formed a hammer candlestick pattern today, last 2 times it formed we saw a big rally as seen in below chart. Will History repeat itself. As per time analysis either tomorrow or day after we should see a big move in market.

- Nifty Future Feb Open Interest Volume is at 1.63 cores with addition of 1.3 lakhs in Open Interest,so addition of long.Series is just 4 days old still we are not seeing any major addition in OI, suggesting big players are still on sidelines.

- Total Future & Option trading volume at 1.08 lakh with total contract traded at 2.2 lakh,PCR (Put to Call Ratio) at 0.91.

- 6200 Nifty CE is having highest OI at 50.4 lakhs , remain resistance for the series, no major addition today in 6200,6100 CE added 2.5 Lakhs and 6000 CE add 1.5 Lakh in OI. 6000 CE OI addition is still near 25 lakhs so fall near 5970-6000 can be bought into and last 2 days fall is getting bought into. 5700-6300 CE added 5.5 Lakh in OI.FII’s bought 3.3 K contract of CE mostly in 6400 CE and 2.4 K were shorted.

- 6000 PE is having highest OI at 75.7 lakhs, so base at 6000 at start of series, 5900 PE has added 3.1 lakhs, 5800 and 5700 again added 7.1 lakh in OI.FII’s bought 9.1 K contract of PE and 4.9 K PE were shorted.

- FIIs sold 576 cores in Equity ,and DII bought 815 cores in cash segment.INR closed at 62.57

- Nifty Futures Trend Deciding level is 6019 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6058 and BNF Trend Changer Level (Positional Traders) 10222.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6028 Tgt 6046,6070 and 6097 (Nifty Spot Levels)

Sell below 6001 Tgt 5980,5962 and 5938 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/